Checking Accounts

Not sure which checking account is the best fit?

Compare all checking accounts

Take a quiz to find your account

Bank Easy

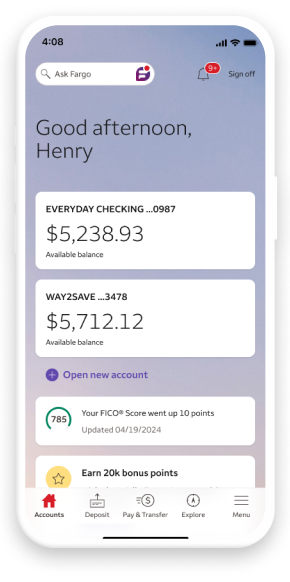

Get the app loved by millions

9M ratings | 4.9 stars

Plus all the features of a Wells Fargo checking account

Online and mobile banking

Access your account and pay bills online from virtually anywhere, anytime

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC (WFCS) and Wells Fargo Advisors Financial Network, LLC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company, and Members SIPC (Wells Fargo has provided this link but does not control or endorse the website and is not responsible for the content, links, privacy policy, or security policy of the website.).

How was your experience? Give us feedback.

Mobile deposit is only available through the Wells Fargo Mobile® app on eligible mobile devices. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s Online Access Agreement and your applicable business account fee disclosures for other terms, conditions, and limitations.

Digital wallets may not be available on all devices.

Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Terms and conditions apply. To send or receive money with Zelle®, both parties must have an eligible checking or savings account. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers purchase protection for payments made with Zelle® - for example, if you do not receive the item you paid for or the item is not as described or as you expected. Payment requests to persons not already enrolled with Zelle® must be sent to an email address. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier's message and data rates may apply. Account fees (e.g., monthly service, overdraft, Small Business Account Analysis fees) may apply to Wells Fargo account(s) with which you use Zelle®.

Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier’s message and data rates may apply. Fargo is only available on the smartphone versions of the Wells Fargo Mobile® app.

You must be a Wells Fargo account holder of an eligible Wells Fargo consumer account with a FICO® Score available, and enrolled in Wells Fargo Online®. Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts, but other consumer accounts may also be eligible. Contact Wells Fargo for details. Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier's message and data rates may apply.

Please note that the score provided under this service is for educational purposes and may not be the score used by Wells Fargo to make credit decisions. Wells Fargo looks at many factors to determine your credit options; therefore, a specific FICO® Score or Wells Fargo credit rating does not guarantee a specific loan rate, approval of a loan, or an upgrade on a credit card.

Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier's message and data rates may apply.

Other fees may apply, and it is possible for the account to have a negative balance. Please see the Wells Fargo Consumer Account Fee and Information Schedule and Deposit Account Agreement for details.

If you convert from a Wells Fargo account with check writing ability to a Clear Access Banking account, any outstanding check(s) presented on the new Clear Access Banking account on or after the date of conversion will be returned unpaid. The payee may charge additional fees when the check is returned. Make sure that any outstanding checks have been paid and/or you have made different arrangements with the payee(s) for the checks you have written before converting to the Clear Access Banking account.

Our overdraft fee for Consumer checking accounts is $35 per item (whether the overdraft is by check, ATM withdrawal, debit card transaction, or other electronic means), and we charge no more than three overdraft fees per business day. Overdraft fees are not applicable to Clear Access Banking accounts.

The payment of transactions into overdraft is discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is overdrawn or you have had excessive overdrafts. You must promptly bring your account to a positive balance.

(A) If your Prime Checking or Premier Checking account is converted to another checking product or closed by us or you, all linked accounts are delinked from the Prime Checking or Premier Checking account and effective immediately, benefits no longer apply, including benefits to your now delinked accounts. You'll no longer receive discounts, options to avoid fees on other products or services, or the Relationship Interest Rate; for time accounts (CDs), this change will occur at renewal. Your delinked accounts will revert to the Bank's current applicable interest rate or fee at that time. (B) If you or we delink an account from your Prime Checking or Premier Checking account but other accounts remain linked, the loss of all benefits and the other consequences described above in (A) will immediately apply to the delinked account. Benefits available to your Prime Checking or Premier Checking account and any remaining linked accounts will continue.

With Extra Day Grace Period, if your account is overdrawn, you have an additional business day (extra day) to make covering deposits and/or transfers to avoid overdraft fees. If your available balance as of 11:59 pm Eastern Time on your extra day is positive, the pending overdraft fees for the prior business day’s overdraft items will be waived. If your available balance as of 11:59 pm Eastern Time is enough to cover some, but not all, of the prior business day’s overdraft items, the available balance will be applied to the transactions in the order that they posted to your account (based on our posting order practices described in the Deposit Account Agreement). Any overdraft items that are not covered by 11:59 pm Eastern Time on your extra day are subject to applicable overdraft fees. All deposits and transfers are subject to the Bank’s Availability of Funds Policy. Please see the Wells Fargo Deposit Account Agreement for more details.

Other fees may apply, and it is possible for the account to have a negative balance. Please see the Wells Fargo Consumer Account Fee and Information Schedule and Deposit Account Agreement for details.

With Early Pay Day, the Bank may make certain direct deposits available to you one to two business days before we receive the funds from the payor, which is typically your employer. Early Pay Day is not guaranteed, may vary between pay periods, and we may stop providing it at any time without advance notice to you. Our ability to provide early access to funds may be limited by many factors, such as when we receive notice of payment from your payor. It is always your obligation to verify that the funds are available in your account before spending them. Available for personal accounts only. See our Deposit Account Agreement for more details.

With Zero Liability protection, you will be reimbursed for promptly reported unauthorized card transactions, subject to certain conditions. Please see the applicable Wells Fargo account agreement or debit and ATM card terms and conditions for information on liability for unauthorized transactions.

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iCloud Keychain, iPad, iPad Pro, iPhone, iTunes, Mac, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Wallet is a trademark of Apple Inc. App Store is a service mark of Apple Inc.

Android, Google Play, Chrome, Pixel and other marks are trademarks of Google LLC.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

See the Consumer Account Fee and Information Schedule and Deposit Account Agreement for additional consumer account information.

Deposit products offered by Wells Fargo Bank, N.A. Member FDIC.

RSNIP-08262026-7681235.1.1

LRC-0624