Everyday Checking

Our most popular checking account

Open with $25

How to avoid the $15 monthly service fee

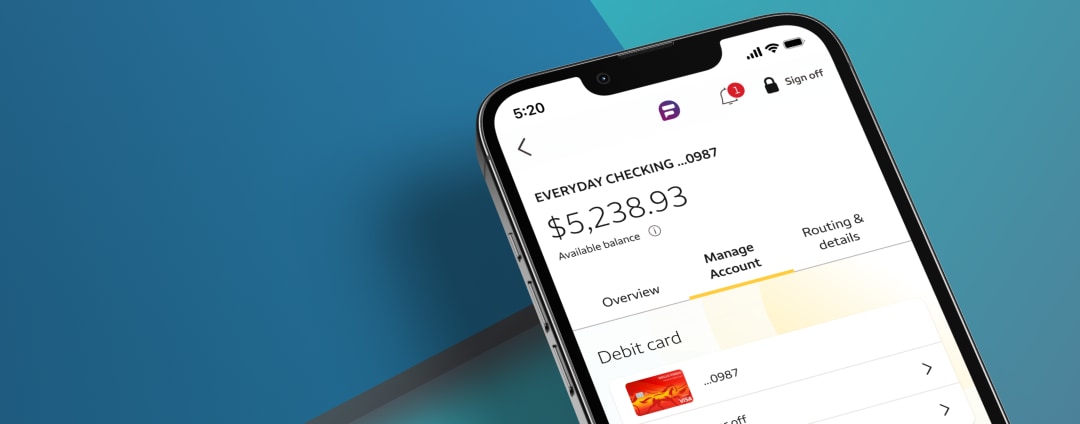

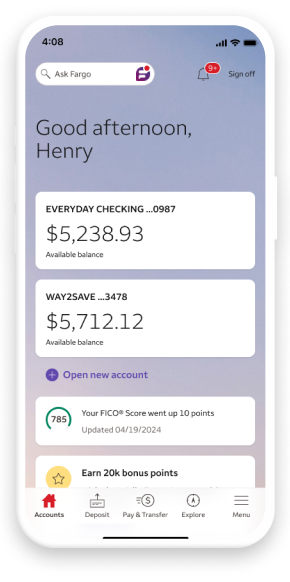

Screen image is simulated

Best account for everyday convenience

Flexible ways to avoid the monthly service fee

Why pay fees? Everyday Checking has more options to avoid the fee.

Multiple ways to pay

Checks, Zelle®, Bill Pay, digital wallets, and contactless debit card

Everyday Checking

fees and details

You can avoid the monthly service fee with one of the following each fee period.

- $500 or more in total qualifying electronic deposits

- $1,500 minimum daily balance

- $5,000 or more in qualifying deposit balances, investment balances, or both

- The primary account owner is 17 - 24 years old

- A qualifying monthly non-civilian military direct deposit with the Wells Fargo Worldwide Military Banking program

- Must be 17 or older

- 17-year-olds must open at a branch

- IDs required to open

Bank with confidence

Bank Easy

Get the app loved by millions

9M ratings | 4.9 stars

Not sure which checking account is the best fit?

Compare all checking accounts

Take a quiz to find your account

Everyday Checking FAQs

How was your experience? Give us feedback.

The fee period is the period used to calculate the monthly service fee. The fee period details are provided on the Monthly Service Fee Summary located in your account statement.

On the last business day of each fee period balances in eligible Wells Fargo accounts will be automatically totaled. Eligible accounts include consumer deposit account balances (checking, savings, CDs, FDIC-insured IRAs), certain investment account balances, and applicable Wells Fargo bank fiduciary and custody accounts.

When the primary account owner reaches the age of 25, age can no longer be used to avoid the monthly service fee.

You will receive your Worldwide Military Banking program benefits 45 days after your qualifying non-civilian military direct deposit is deposited into your eligible Wells Fargo checking account. For more information on the qualifying non-civilian military direct deposit, program qualifications and benefits, please visit wellsfargo.com/military/worldwide-military-banking or wellsfargo.com/depositdisclosures.

Mobile deposit is only available through the Wells Fargo Mobile® app on eligible mobile devices. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s Online Access Agreement and your applicable business account fee disclosures for other terms, conditions, and limitations.

Digital wallets may not be available on all devices.

Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Terms and conditions apply. To send or receive money with Zelle®, both parties must have an eligible checking or savings account enrolled with Zelle® through their bank. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers purchase protection for payments made with Zelle® - for example, if you do not receive the item you paid for or the item is not as described or as you expected. Payment requests to persons not already enrolled with Zelle® must be sent to an email address. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier’s message and data rates may apply. Account fees (e.g., monthly service, overdraft, Small Business Account Analysis fees) may apply to Wells Fargo account(s) with which you use Zelle®.

Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier’s message and data rates may apply. Fargo is only available on the smartphone versions of the Wells Fargo Mobile® app.

You must be a Wells Fargo account holder of an eligible Wells Fargo consumer account with a FICO® Score available, and enrolled in Wells Fargo Online. Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts, but other consumer accounts may also be eligible. Contact Wells Fargo for details. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

Please note that the score provided under this service is for educational purposes and may not be the score used by Wells Fargo to make credit decisions. Wells Fargo looks at many factors to determine your credit options; therefore, a specific FICO® Score or Wells Fargo credit rating does not guarantee a specific loan rate, approval of a loan, or an upgrade on a credit card.

Wells Fargo and Fair Isaac are not credit repair organizations as defined under federal and state law, including the Credit Repair Organizations Act. Wells Fargo and Fair Isaac don’t provide credit repair services or advice or assistance with rebuilding or improving your credit record, credit history, or credit rating.

Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier's message and data rates may apply.

With Zero Liability protection, you will be reimbursed for promptly reported unauthorized card transactions, subject to certain conditions. Please see the applicable Wells Fargo account agreement or debit and ATM card terms and conditions for information on liability for unauthorized transactions.

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iCloud Keychain, iPad, iPad Pro, iPhone, iTunes, Mac, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Wallet is a trademark of Apple Inc. App Store is a service mark of Apple Inc.

Android, Google Play, Chrome, Pixel and other marks are trademarks of Google LLC.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Wells Fargo Bank, N.A. Member FDIC.

DT1-08062026-12-8599453-1.1