Inicio de sesión en Banca por Internet para Empresas Wells Fargo Business Online Banking y servicios para empresas

Bienvenido

Inicie sesión para administrar sus cuentas.

Una cuenta de cheques creada para su empresa

Haga que los beneficios trabajen a su favor

Obtenga ayuda con la búsqueda de productos y servicios para su empresa

Utilice nuestro Selector de Productos para encontrar opciones que se adapten a las necesidades de su empresa

¿Por qué elegir a Wells Fargo?

A su medida

Ofrecemos opciones personalizadas al colaborar con usted para comprender a fondo su empresa, incluidas sus metas a largo plazo.

Apoyo

Nuestros representantes bancarios tienen el conocimiento necesario para ayudarle a impulsar su empresa, ahora y en el futuro.

Simplicidad

Proporcionamos productos, herramientas y recursos fáciles de usar para empresas para ayudar a simplificar su vida financiera.

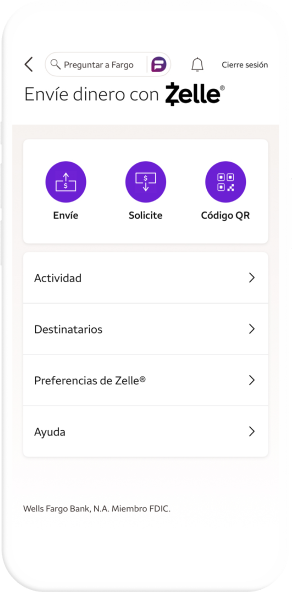

Zelle® para su empresa

Acelere sus negocios con Zelle®

Recursos para empresas

Obtenga los recursos adecuados para este momento

Estamos aquí para ayudarle con sugerencias, herramientas y orientación para ayudar a que su empresa prospere.

Prepárese antes de presentar su solicitud

Reúna los documentos que necesitará para abrir una cuenta de cheques para empresas.

Ayude a proteger su empresa

Obtenga más información sobre marcas comerciales, derechos de autor y patentes.

Servicios de nómina

Ayuda para satisfacer sus necesidades de nómina y recursos humanos.

Se requiere la inscripción en Zelle® a través de la banca por Internet Wells Fargo Online® o de la banca por Internet para empresas Wells Fargo Business Online®. Se aplican términos y condiciones. Para enviar o recibir dinero con Zelle®, ambas partes deben tener una cuenta de cheques o de ahorros elegible inscrita en Zelle® a través de su banco. Las transacciones entre usuarios inscritos se realizan normalmente en cuestión de minutos. Para su protección, Zelle® solo debería usarse para enviar dinero a familiares, amigos y otras personas de confianza. Ni Wells Fargo ni Zelle® ofrecen protección para compras para los pagos que se realicen con Zelle® en caso de que, por ejemplo, usted no reciba el artículo por el que pagó o el artículo no coincida con su descripción o no cumpla con sus expectativas. Las solicitudes de pago hechas a personas que aún no están inscritas en Zelle® se deben enviar a una dirección de correo electrónico. Para obtener más información, consulte el Anexo del Servicio de Transferencia de Zelle® del Contrato de Acceso por Internet de Wells Fargo. Es posible que se apliquen tarifas por servicio de mensajería y datos de su proveedor de telefonía móvil. Podrían aplicarse cargos de la cuenta (p. ej., cargos mensuales por servicio, cargos por sobregiro, cargos del análisis de cuentas para pequeñas empresas) a la(s) cuenta(s) de Wells Fargo con la(s) que usted use Zelle®.

Android, Google Play, Chrome, Pixel y otras marcas son marcas de Google LLC.

Apple, el logotipo de Apple, Apple Pay, Apple Watch, Face ID, iCloud Keychain, iPad, iPad Pro, iPhone, iTunes, Mac, Safari y Touch ID son marcas comerciales de Apple Inc. registradas en EE. UU. y en otros países. Apple Wallet es una marca comercial de Apple Inc. App Store es una marca de servicio de Apple Inc.

Los Servicios para Comerciantes son proporcionados por Wells Fargo Merchant Services, L.L.C. y Wells Fargo Bank, N.A.

Wells Fargo Merchant Services, L.L.C. no ofrece productos de depósito y sus servicios no están garantizados ni asegurados por la FDIC ni por ninguna otra agencia del gobierno. Cuando usted usa una cuenta dedepósito de Wells Fargo Bank para la liquidación o para otros fines relacionados con los Servicios para Comerciantes, deberá usar una cuenta de depósito para empresas o comercial de Wells Fargo Bank. Los productos de depósito se ofrecen a través de Wells Fargo Bank, N.A. Miembro FDIC. Los Servicios para Comerciantes están sujetos a solicitud, revisión de crédito de la empresa y sus propietarios, y aprobación.

Zelle® y cualquier marca relacionada con Zelle® son propiedad exclusiva de Early Warning Services, LLC y son utilizadas aquí bajo licencia.

Los productos de depósito se ofrecen a través de Wells Fargo Bank, N.A. Miembro FDIC.

DT1-10012026-12-8613332-1.1