Cuentas de cheques para estudiantes y adolescentes

¿Quiere una cuenta para adolescentes sin la preocupación de cargos por sobregiro y cargos mensuales por servicio?

No busque otra que la cuenta Clear Access Banking.

Las personas de 17 años de edad o menos deben abrir la cuenta en una sucursal.

Cuenta Clear Access Banking:

diseñada pensando en los adolescentes

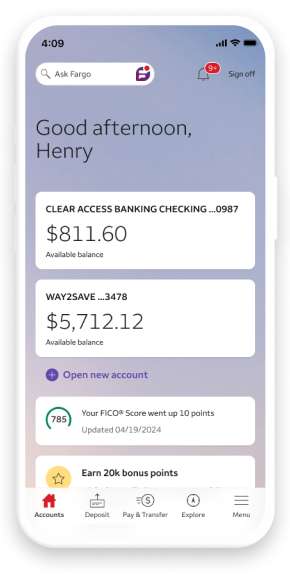

Banca móvil conveniente

La banca para adolescentes es más fácil con Zelle®, depósito por banca móvil, y billeteras digitales.

Sin cargos por sobregiro. Punto.

Clear Access Banking es una gran cuenta para ayudar a los adolescentes a administrar su dinero y no tiene cargos por sobregiro.

Evite el cargo mensual por servicio

Se exime del pago del cargo mensual por servicio a los titulares principales de una cuenta que tengan entre 13 y 24 años de edad.

Detalles sobre la cuenta

Clear Access Banking

- Sin cargos por sobregiro

- Cuenta de cheques sin cheques

por servicio de $5

- El titular principal de la cuenta tiene entre 13 y 24 años de edad

- Más formas de evitar el cargo

y otros cargos

- Debe tener 13 años de edad o más

- Los adolescentes de 13 a 16 años de edad necesitan un cotitular adulto

- Las personas de 17 años de edad o menos deben abrir la cuenta en una sucursal

- Identificaciones necesarias para abrirla

Cuenta de Cheques Everyday Checking:

otra opción para estudiantes

Detalles sobre la cuenta

Everyday Checking

por servicio de $10

- El titular principal de la cuenta tiene entre 17 y 24 años de edad

- Más formas de evitar el cargo

y otros cargos

- Debe tener 17 años de edad o más

- Los adolescentes de 17 años deberán abrir la cuenta en una sucursal

- Identificaciones necesarias para abrirla

Banca fácil

Descargue la app usada por millones

9 millones de calificaciones | 4.9 estrellas

Desarrolle buenos hábitos financieros que perduran

Abra una cuenta de ahorros Way2Save® Savings y establezca transferencias automáticas para ayudar a los estudiantes a alcanzar sus metas de ahorro.

Aprenda cómo crear un presupuesto para la universidad, construir antecedentes de crédito y establecer metas con CollegeSTEPS® (en inglés) de Wells Fargo.

Acceda a miles de millones de dólares para el financiamiento de la educación superior, además de las estrategias y herramientas para explorarlas con éxito en wellsfargo.com/scholarships (en inglés).

Preguntas frecuentes sobre cuentas de cheques para estudiantes

¿Cómo fue su experiencia? Denos su opinión.

Podrían aplicarse otros cargos y es posible que la cuenta tenga un saldo negativo. Consulte el Programa de Cargos e Información de la Cuenta al Consumidor y el Contrato de la Cuenta de Depósito de Wells Fargo para obtener detalles.

Si usted convierte de una cuenta de Wells Fargo que tiene la capacidad de girar cheques a una cuenta Clear Access Banking, todo cheque pendiente presentado en la nueva cuenta Clear Access Banking en la fecha de la conversión o después de esa fecha se devolverá sin pagar. El beneficiario podría cobrar cargos adicionales cuando se devuelva el cheque. Antes de realizar la conversión a la cuenta Clear Access Banking, asegúrese de que se hayan pagado los cheques pendientes y/o de que usted haya hecho otros arreglos con el (los) beneficiario(s) por los cheques que haya girado.

El depósito inicial mínimo es de $25. El cargo mensual por servicio para la Cuenta de Cheques Everyday Checking es de $10 y se puede evitar cuando el titular principal de la cuenta tenga entre 17 y 24 años de edad. El cargo mensual por servicio para la Cuenta Clear Access Banking es de $5 y se puede evitar cuando el titular principal de la cuenta tenga entre 13 y 24 años de edad. Cuando el titular principal de la cuenta cumple 25 años, la edad ya no puede utilizarse para evitar el cargo mensual por servicio. Los clientes de la Cuenta de Cheques Everyday Checking y la Cuenta Clear Access Banking tienen otra(s) manera(s) de evitar el cargo mensual por servicio. Los clientes que tengan entre 13 y 16 años de edad deberán abrir la Cuenta Clear Access Banking con un cotitular adulto. Consulte a un representante bancario de Wells Fargo o el Programa de Cargos e Información de la Cuenta al Consumidor disponible en wellsfargo.com/es/online-banking/consumer-account-fees/ para obtener más información sobre otros cargos que podrían aplicarse y sobre las opciones para que se le exima del pago del cargo mensual por servicio.

Nuestro cargo por sobregiro para las cuentas de cheques al consumidor es de $35 por partida (ya sea que el sobregiro se produjo mediante cheque, retiro en cajero automático [ATM], transacción con tarjeta de débito u otros medios electrónicos), y no cobramos más de tres cargos por sobregiro por día laborable. Los cargos por sobregiro no se aplican a las cuentas Clear Access Banking.

El pago de las transacciones en concepto de sobregiro es discrecional y nos reservamos el derecho de no pagar. Por ejemplo, generalmente no pagamos sobregiros si su cuenta está sobregirada o si ha tenido demasiados sobregiros. Deberá hacer que su cuenta vuelva a tener un saldo positivo sin demora.

Con Extra Day Grace Period, si su cuenta está sobregirada, usted tendrá un día laborable adicional (día adicional) para realizar depósitos y/o transferencias que cubran las transacciones a fin de evitar cargos por sobregiro. Si su saldo disponible a las 11:59 p.m., hora del este, de su día adicional es positivo, se le eximirá del pago de los cargos por sobregiro pendientes correspondientes a las partidas sobregiradas del día laborable anterior. Si su saldo disponible a las 11:59 p.m., hora del este, es suficiente para cubrir algunas, pero no todas, las partidas sobregiradas del día laborable anterior, el saldo disponible se aplicará a las transacciones en el orden en que estas se registraron en su cuenta (sobre la base de nuestras prácticas de orden de registro descritas en el Contrato de la Cuenta de Depósito). Todas las partidas sobregiradas que no estén cubiertas a más tardar a las 11:59 p.m., hora del este, de su día adicional estarán sujetas a los cargos por sobregiro aplicables. Todos los depósitos y transferencias están sujetos a la Política de Disponibilidad de Fondos del banco. Consulte el Contrato de la Cuenta de Depósito de Wells Fargo para obtener más detalles.

El Servicio de Depósito por Banca Móvil solo está disponible a través de la app de Wells Fargo Mobile® en dispositivos móviles elegibles. Se aplican límites en cuanto a los depósitos y otras restricciones. Algunas cuentas no son elegibles para Depósito por Banca Móvil. La disponibilidad podría verse afectada por el área de cobertura de su proveedor de telefonía móvil. Es posible que se apliquen tarifas por servicio de mensajería y datos de su proveedor de telefonía móvil. Consulte el Contrato de Acceso por Internet de Wells Fargo y las declaraciones informativas correspondientes sobre los cargos de su cuenta para empresas para conocer otros términos, condiciones y limitaciones.

Las billeteras digitales podrían no estar disponibles en todos los dispositivos. Es posible que se apliquen tarifas por servicio de mensajería y datos de su proveedor de telefonía móvil.

Se requiere la inscripción en Zelle® a través de la Banca por Internet Wells Fargo Online® o de la Banca por Internet para Empresas Wells Fargo Business Online®. Se aplican términos y condiciones. Para enviar o recibir dinero con Zelle®, ambas partes deben tener una cuenta de cheques o de ahorros elegible. Las transacciones entre usuarios inscritos se realizan normalmente en cuestión de minutos. Para su protección, Zelle® solo debería usarse para enviar dinero a familiares, amigos y otras personas de confianza. Ni Wells Fargo ni Zelle® ofrecen protección para compras para los pagos que se realicen con Zelle® en caso de que, por ejemplo, usted no reciba el artículo por el que pagó o el artículo no coincida con su descripción o no cumpla con sus expectativas. Las solicitudes de pago hechas a personas que aún no están inscritas en Zelle® se deben enviar a una dirección de correo electrónico. Para obtener más información, consulte el Anexo del Servicio de Transferencia de Zelle® del Contrato de Acceso por Internet de Wells Fargo. Es posible que se apliquen tarifas por servicio de mensajería y datos de su proveedor de telefonía móvil. Podrían aplicarse cargos de la cuenta (p. ej., cargos mensuales por servicio, cargos por sobregiro, cargos del análisis de cuentas para pequeñas empresas) a la(s) cuenta(s) de Wells Fargo con las que usted use Zelle®.

La disponibilidad podría verse afectada por el área de cobertura de su proveedor de telefonía móvil. Es posible que se apliquen tarifas por servicio de mensajería y datos de su proveedor de telefonía móvil. Fargo solo está disponible en las versiones para teléfono inteligente de la app de Wells Fargo Mobile®.

Usted debe ser el titular de una cuenta al consumidor de Wells Fargo elegible con una Puntuación FICO® Score disponible y estar inscrito en la banca por Internet Wells Fargo Online. Las cuentas al consumidor de Wells Fargo elegibles incluyen las cuentas de depósito, de préstamo y de crédito, si bien otras cuentas al consumidor también podrían ser elegibles. Comuníquese con Wells Fargo para obtener detalles.

Tenga en cuenta que la puntuación proporcionada en este servicio tiene fines educativos y es posible que no sea la puntuación usada por Wells Fargo para tomar decisiones de crédito. Hay muchos factores que Wells Fargo analiza para determinar sus opciones de crédito; por lo tanto, una Puntuación FICO® Score o clasificación de crédito de Wells Fargo específicas no garantizan una tasa de préstamo específica, la aprobación de un préstamo o una mejora de categoría en una tarjeta de crédito.

Wells Fargo y Fair Isaac no son organizaciones de reparación de crédito, según lo definido en virtud de las leyes federales y estatales, incluida la Credit Repair Organizations Act (Ley de Organizaciones de Reparación de Crédito). Wells Fargo y Fair Isaac no ofrecen servicios de reparación de crédito ni asesoramiento o asistencia con la reconstrucción o la mejora de su registro de crédito, historial de crédito o clasificación de crédito.

Desactivar su tarjeta de débito no reemplaza la necesidad de reportar la pérdida o el robo de su tarjeta. Comuníquese con nosotros de inmediato si usted cree que se han realizado transacciones no autorizadas. Desactivar su tarjeta no suspenderá aquellas de sus transacciones que se presenten como recurrentes ni las transacciones realizadas con otras tarjetas vinculadas a su cuenta de depósito. El registro de reembolsos, revocaciones y ajustes de abono en su cuenta continuarán. Todos los números de tarjetas digitales vinculadas a la tarjeta también se desactivarán. La disponibilidad podría verse afectada por el área de cobertura de su proveedor de telefonía móvil. Es posible que se apliquen tarifas por servicio de mensajería y datos de su proveedor de telefonía móvil.

Se aplican términos y condiciones. Es posible que se apliquen las tarifas por servicio de mensajería y datos de su proveedor de telefonía móvil. Consulte el Contrato de Acceso por Internet de Wells Fargo para obtener más información.

Apple, el logotipo de Apple, Apple Pay, Apple Watch, Face ID, iCloud Keychain, iPad, iPad Pro, iPhone, iTunes, Mac, Safari y Touch ID son marcas comerciales de Apple Inc. registradas en EE. UU. y en otros países. Apple Wallet es una marca comercial de Apple Inc. App Store es una marca de servicio de Apple Inc.

Android, Google Play, Chrome, Pixel y otras marcas son marcas de Google LLC.

FICO es una marca comercial registrada de Fair Isaac Corporation en Estados Unidos y en otros países.

Zelle® y cualquier marca relacionada con Zelle® son propiedad exclusiva de Early Warning Services, LLC y son utilizadas aquí bajo licencia.

Consulte el Programa de Cargos e Información de la Cuenta al Consumidor y el Contrato de la Cuenta de Depósito para obtener información adicional sobre la cuenta al consumidor.

Wells Fargo Bank, N.A. Miembro FDIC.

QSR-07242026-7567100.1.1

LRC-0824