Business checking accounts

Discover what’s right for your business

Reasons to choose a Wells Fargo business checking account

Deposit checks directly into your bank account using our mobile app

Pay vendors, employees, and bills using our payment services

Add debit cards to your digital wallet and use contactless debit cards

Manage users and control who has access to your business accounts

Monitor your account balances, track recent purchases, and more

Customize checks and eligible business debit cards with your company logo

Get alerts from Wells Fargo if we notice unusual activity on your business account

Report unauthorized transactions promptly so we can take action to protect your bank account

24/7 account monitoring and may contact you if unusual activity is detected

Bank almost anywhere business takes you

Business Checking FAQs

to the lowest ending daily balance recorded during the fee period after all transactions have gone through nightly processing

How was your experience? Give us feedback.

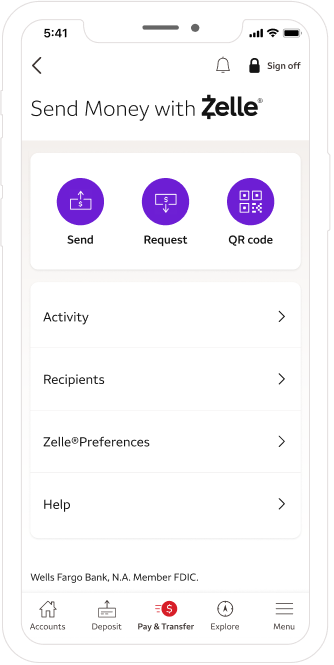

Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Terms and conditions apply. To send or receive money with Zelle®, both parties must have an eligible checking or savings account enrolled with Zelle® through their bank. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers purchase protection for payments made with Zelle® - for example, if you do not receive the item you paid for or the item is not as described or as you expected. Payment requests to persons not already enrolled with Zelle® must be sent to an email address. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier’s message and data rates may apply. Account fees (e.g., monthly service, overdraft, Small Business Account Analysis fees) may apply to Wells Fargo account(s) with which you use Zelle®.

Sign-up may be required. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

The combined balance is determined on the last business day of your fee period. Combined business deposit balances include the average ledger balance in your Initiate Business Checking account plus other qualified accounts, including:

- Business checking accounts: Initiate Business Checking, Navigate Business Checking, Optimize Business Checking, and Analyzed Business Checking

- Business savings accounts: Business Market Rate Savings and Business Platinum Savings

- Business time accounts (CDs): Business Time Accounts

The combined business deposit balance wavier will be applied as a refund after the statement cycle ends.

Customers who own a Premier Checking, Private Bank Checking, or Private Bank Interest Checking account and own a business with an Initiate Business Checking, Navigate Business Checking, Business Market Rate Savings, or Business Platinum Savings will have their monthly service fee waived on the business account(s). Customer must be an individual owner, joint owner, or trustee of the Premier Checking, Private Bank Checking, or Private Bank Interest Checking account and be a business owner with transaction authority on the business account. If a business has multiple owners, the benefit will apply as long as one of the owners has a Premier Checking, Private Bank Checking, or Private Bank Interest Checking account. In the event a customer no longer has a Premier Checking, Private Bank Checking, or Private Bank Interest Checking account, that customer is no longer eligible for the monthly service fee waiver benefit.

Mobile deposit is only available through the Wells Fargo Mobile® app on eligible mobile devices. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s Online Access Agreement and your applicable business account fee disclosures for other terms, conditions, and limitations.

The combined balance is determined one business day prior to the last business day of your fee period. Combined business deposit balances include the average ledger balance in your Navigate Business Checking® account plus other qualified linked accounts:

- Your business checking accounts: Initiate Business Checking® and Additional Navigate Business Checking PLUS

- Your business savings accounts: Business Market Rate Savings and Business Platinum Savings PLUS

- Your business time accounts (CDs): Business Time Account (CD)

Your Navigate Business Checking account cannot be linked to another Navigate Business Checking account for combined balances. Other accounts linked to your Navigate Business Checking account for combined balances, such as a Business Market Rate Savings account, cannot simultaneously be linked to another Navigate Business Checking account to avoid the monthly service fee with combined balances.

See the Business Account Fee and Information Schedule for additional business account information.

Transactions means all checks deposited and all withdrawals or debits posted to your account, including paper and electronic, except debit card purchases and debit card payments.

Optimize Business Checking customers can access advanced features through Wells Fargo VantageSM. Available within a billing relationship. Enrollment in Vantage is required and additional fees may apply. Contact your banker for a complete description of services, fees, and enrollment instructions.

The first five Optimize Business Checking accounts within a billing relationship are included in the monthly maintenance fee of $75. Additional Optimize Business Checking accounts in excess of five are $30 each. See the Business Account Fee and Information Schedule for additional business account information.

The Optimize Business Checking account is eligible for an earnings allowance to offset eligible fees and expenses, including certain service fees. To calculate your earnings allowance, we apply the earnings credit rate to the investable balance available for services in your account. The earnings credit rate is a variable rate that the Bank can change at any time. The rate appears on your client analysis statement.

If your earnings allowance is greater than the total eligible fees for a given statement period, we won't credit that amount to your account or carry it forward to the following statement period. In any statement period where your fees exceed your earnings allowance, we'll debit your account or invoice you for the difference.

Optimize Business Checking customers may also deposit checks via Wells Fargo VantageSM by enrolling in our Desktop Deposit® service. Additional fees may apply.

Digital wallets may not be available on all devices. Your mobile carrier's message and data rates may apply.

Wells Fargo reserves the right to accept or reject any artwork, images, or logos. For example, any third-party trademarks, copyrighted materials, or name, image, and likeness of any public figures will not be approved.

Android, Google Play, Chrome, Pixel and other marks are trademarks of Google LLC.

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iCloud Keychain, iPad, iPad Pro, iPhone, iTunes, Mac, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Wallet is a trademark of Apple Inc. App Store is a service mark of Apple Inc.

*Screen images simulated

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Wells Fargo Bank, N.A. Member FDIC.

DT1-08132026-12-8303052-1.1