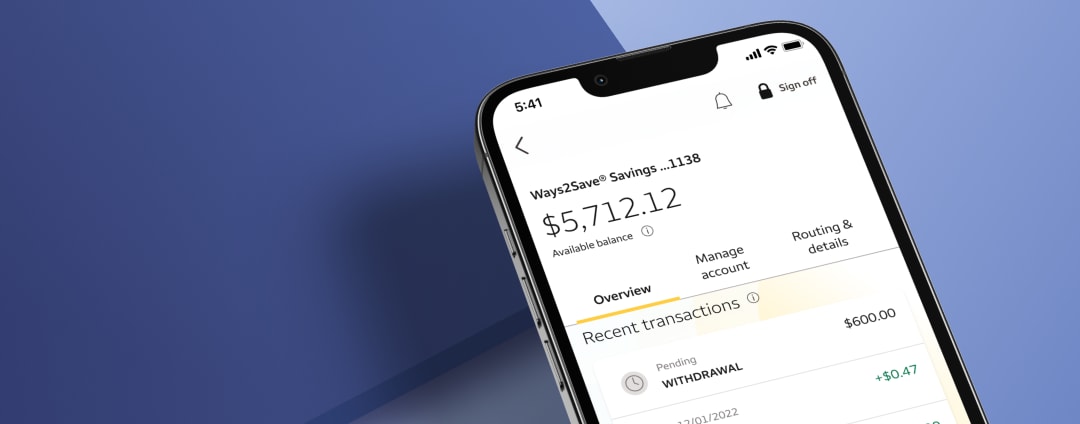

Way2Save® Savings

Little by little, saving adds up

Open with $25

How to avoid the $5 monthly service fee

Screen image is simulated

A great account to help build your savings

Save as you spend

Set up Save As You Go® to automatically transfer $1 for every completed Bill Pay or one-time debit card purchase

Why pay fees?

Way2Save Savings has more ways to avoid the monthly service fee

Way2Save® interest rates

Variable rates (compounded daily) Compare rates

Wells Fargo Way2Save® Savings interest rate

Rates are unavailable at this time. Please check back later or call us at 1-800-869-3557.

Account fees and details

Avoid the $5 monthly service fee with one of the following each fee period:

- $300 minimum daily balance

- 1 automatic transfer each fee period of $25 or more from a linked Wells Fargo checking account

- 1 automatic transfer each business day within the fee period of $1 or more from a linked Wells Fargo checking account

- 1 or more Save As You Go transfers from a linked Wells Fargo checking account

- Primary account owner is 24 years old or under

- Minors 12 and under can open a joint account with an adult with several options

- Anyone 13 and older can open as a primary owner

- 17 and under must open at a branch

- Must be 18 or older to apply online

- IDs required to open

Way2Save Savings account FAQs

APY (Annual Percentage Yield)

The APY (Annual Percentage Yield) is a percentage rate that reflects the total amount of interest paid on the account, based on the interest rate compounded daily for a 365-day period.

If you receive a periodic statement, that statement will include the Annual Percentage Yield Earned (APYE) on your account for the period covered by the statement.

How was your experience? Give us feedback.

The fee period is the period used to calculate the monthly service fee. The fee period details are provided on the Monthly Service Fee Summary located in your account statement.

Terms and conditions apply. Mobile carrier's message and data rates may apply. See Wells Fargo's Online Access Agreement for more information.

A qualifying Save As You Go transfer is an automatic transfer of $1 from your linked Wells Fargo checking account to your Way2Save Savings account each time you (or any authorized signer or joint owner) use your debit card for a one-time purchase or complete a Bill Pay transaction through online banking, and the one-time debit card purchase or Bill Pay transaction posts to the account. We reserve the right to determine through our sole discretion if a particular transaction is a qualifying transaction.

When the primary account owner reaches the age of 25, age can no longer be used to avoid the monthly service fee. Customers 12 and under must have an adult co-owner.

My Savings Plan requires a Wells Fargo savings account.

Current Deposit Rates for -

Annual Percentage Yields (APYs) and Interest Rates shown are offered on accounts accepted by the Bank and effective for the dates shown above, unless otherwise noted. Interest Rates are subject to change without notice. Interest is compounded daily and paid monthly. Interest is calculated and accrued daily based on the daily collected balances in the account. Accrued interest is considered to be earned and will be paid only when the total interest accrued reaches $0.01 or more. In any month the amount of accrued interest is less than $0.01, periodic statements will show no Annual Percentage Yield Earned (APYE) or interest earned though interest is accruing. Interest Rates and APYs for all checking and savings accounts are variable and can be changed by the Bank at any time. Fees could reduce earnings.

Wells Fargo interest rates offered within two or more consecutive tiers may be the same. When this is the case, multiple tiers may show as a single tier.

A copy of the then-current rate sheet will be provided to you before you open your account or is available at any time upon request from a banker.

Wells Fargo Bank, N.A. Member FDIC.

QSR-11302026-8025111.1.1

LRC-0525