Wells Fargo is consistently enhancing our security measures and strengthening our layers of protection as threats evolve. You can also help protect your financial accounts by choosing additional security options that fit your needs.

Download the Wells Fargo Mobile® app for easy access to our Security Center, which has tools and resources to help protect your account.

PIN and password help: Learn how to change your PIN or password to help keep your accounts secure.

Security tools

Account alerts

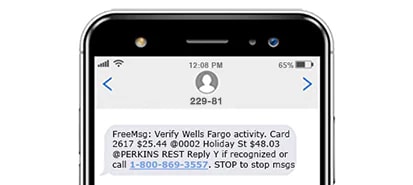

Alerts can help you track your transactions and spot unusual or suspicious activity. Get notified when your card is used for a purchase or withdrawal from your account — so you can contact us quickly if something doesn’t look right. Here are a few of your options:

- Online, phone, or mail purchase: Get alerted when your card is used to make a purchase online, by phone, or mail that exceeds an amount you set.

- ATM withdrawal or cash advance: Receive an alert when your card is used to make a withdrawal or cash advance from your account at an ATM.

- Single purchase: Be notified when a purchase is made with your debit or credit card that exceeds an amount you set, such as $100.

You can choose to receive alerts by text, email, or push notification, as available.

Wells Fargo also monitors your accounts and will notify you when your contact information changes, username or password are updated, or online access is blocked after multiple failed sign-on attempts. We help to keep your money safe by monitoring your accounts and alerting you to certain account activity we find suspicious. We may send a text, email, push notification, or call you if we notice unusual activity on your account. If you receive an alert from us to confirm a transaction, please respond promptly.

Important: Wells Fargo employees will never contact you and ask for your one-time access codes, PIN, or password.

If someone claiming to be from Wells Fargo asks for this information, do not respond. When in doubt, call us immediately using the number on the back of your card.

Card controls

If you misplace your debit, credit, or ATM card, you can sign on to mobile or online banking to temporarily turn it off and turn it back on when you find it. While your card is turned off, most types of new card transactions will not be processed, however, previously authorized recurring payments may be approved.

If your card is lost or stolen, sign on to the mobile app to quickly request a replacement card. You can also sign on and visit the Recurring Payments page to view recurring payments and subscriptions you've set up with merchants and service providers who you may need to update with your new card information.

- Turn card on or off or call 1-800-869-3557 for personal accounts, 1-800-225-5935 for small businesses.

Account Access Manager for Small Business

Account Access Manager enables small business owners to review who has access to their business accounts, remove authorized signers and manage guest users, all through Wells Fargo Business Online®. Be sure to regularly review account access rights and make updates as needed.

Sign-on and authentication options

Securing your mobile device

When you use the Wells Fargo Mobile® app these 4 tips can help you to protect your device:

- Secure your screen. Ensure that your mobile device’s screen is secured with a strong password, PIN, swipe pattern, facial recognition, or fingerprint.

- Activate auto lock. Turn on your device’s auto lock feature so that the screen automatically locks after a period of inactivity.

- Use Wi-Fi carefully. It’s best to avoid using unsecured, public Wi-Fi networks and to turn off your Bluetooth® and Wi-Fi when they are not in use.

- Beware of suspicious emails, text messages, and links. Do not click links or reply to messages that look or sound suspicious. When in doubt, call us immediately.

2-Step Verification at Sign-On

Activate 2-Step Verification at Sign-on, Wells Fargo's version of two-factor authentication (or 2FA), for an additional layer of security when you sign on to mobile or online banking by having Wells Fargo send an access code to your mobile device or email address.

Apple Face ID® and Touch ID

Use your face or fingerprint to sign on instead of your username and password. After you enable the face and fingerprint recognition feature on your mobile device, follow these instructions to complete activation:

Apple Face ID®

- Launch the Wells Fargo Mobile® app

- Tap Set up Face ID

- Enter your username and password and tap Sign On

Apple Touch ID

- Launch the Wells Fargo Mobile® app

- Tap Set Up Touch ID

- Enter your username and password and tap Sign On

Wells Fargo does not store your biometric information.

AndroidTM Biometric Sign-On

Sign on to the Wells Fargo Mobile® app using facial recognition or fingerprint instead of entering your username and password.

- Launch the Wells Fargo Mobile® app

- Tap Set up Biometric sign-on

- Enter your username and password and tap Sign On

Wells Fargo does not store your biometric information.

Passkey

A passkey is a secure, convenient way of signing on without a password.

To create your passkey, sign on and visit Security Center in the app or the Security & Support tab on a computer.

Voice Verification

Voice Verification allows us to identify you by your voice when calling customer service. Whether you want to use our automated phone service or speak with a banker, Voice Verification is a convenient way to access your accounts over the phone.

To activate Voice Verification, call 1-800-869-3557. Select option 0 and ask a banker how to get started.

Sign On

Sign On