Stay on top of your credit and debt

Explore resources to help you improve your credit and manage your debt.

Navegó a una página que no está disponible en español en este momento. Seleccione el enlace si desea ver otro contenido en español.

Página principalTo find out whether you’re ready to take on new debt, you can measure your credit status against the criteria that lenders use when they review your application. When you apply for a new credit account, lenders evaluate your application based on key factors commonly known as the 5 Cs of Credit.

Your credit history is a record of how you’ve managed your credit over time. It includes credit accounts you’ve opened or closed, as well as your repayment history over the past 7-10 years. This information is provided by your lenders, as well as collection and government agencies, to then be scored and reported.

A good credit score shows that you’ve responsibly managed your debts and consistently made on-time payments every month.

Your credit score matters because it may impact your interest rate, term, and credit limit. The higher your credit score, the more you may be able to borrow and the lower the interest rate you could receive.

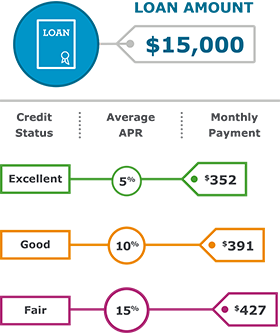

For example, with a good or excellent credit score, you might qualify for a lower interest rate and monthly payment. The example below shows how your monthly payment could vary on a loan of $15,000 depending on your annual percentage rate (APR).

With excellent credit and an average APR of 5%, the monthly payment would be $352. While with good credit and an average APR of 10%, the monthly payment would be $391. But with fair credit and an average APR of 15%, the monthly payment would grow to $427. These rates are for illustrative purposes only.

You can request your credit report at no cost once a year from the top 3 credit reporting agencies — Equifax®, Experian®, and TransUnion® through annualcreditreport.com. When you get your report, review it carefully to make sure your credit history is accurate and free from errors.

It is important to understand that your free annual credit report may not include your credit score, and a reporting agency may charge a fee for your credit score.

Did you know? Eligible Wells Fargo customers can easily access their FICO® Credit Score through Wells Fargo Online® - plus tools tips, and much more. Learn how to access your FICO Score. Don't worry, requesting your score or reports in these ways won't negatively affect your score.

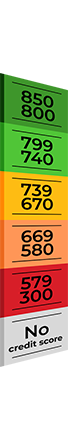

Your credit score reflects how well you've managed your credit. The 3-digit score, sometimes referred to as a FICO® Score, typically ranges from 300-850. Each of the 3 credit reporting agencies use different scoring systems, so the score you receive from each agency may differ. To understand how scores may vary, see how to understand credit scores.

Exceptional (800 or better)

Exceptional (800 or better)

You may generally be able to qualify for the best rates, depending on your debt-to-income (DTI) ratio and the amount of equity you have in any collateral.

Very good (740 - 799)

You may generally be able to qualify for better rates, depending on your debt-to-income (DTI) ratio and the amount of equity you have in any collateral.

Good (670 - 739)

You may typically be able to qualify for credit, depending on your debt-to-income (DTI) ratio and the amount of equity you have in any collateral (but you may not get the best rates).

Fair (580 - 669)

You may have more difficulty obtaining credit and will likely pay higher rates for it.

Poor (300 - 579)

You may have difficulty obtaining unsecured credit.

No score

You may not have built up enough credit to calculate a score, or your credit has been inactive for some time.

Capacity is an indicator of the probability that you'll consistently be able to make payments on a new credit account. Lenders use different factors to determine your ability to repay, including reviewing your monthly income and comparing it to your financial obligations. This calculation is referred to as your debt-to-income (DTI) ratio, which is the percentage of your monthly income that goes toward expenses like rent, and loan or credit card payments.

Lenders look at your debt-to-income (DTI) ratio when they’re evaluating your credit application to assess whether you’re able to take on new debt. A low DTI ratio is a good indicator that you have enough income to meet your current monthly obligations, take care of additional or unexpected expenses, and make the additional payment each month on the new credit account.

Learn how DTI is calculated, see our standards for DTI ratios, and find out how you may improve your DTI. Use our calculator to determine your debt-to-income ratio.

Understand your debt-to-income ratio

Once you’ve calculated your DTI ratio, you’ll want to understand how lenders review it when they're considering your application. Take a look at the guidelines we use:

35% or less: Looking Good - Relative to your income, your debt is at a manageable level

35% or less: Looking Good - Relative to your income, your debt is at a manageable level

You most likely have money left over for saving or spending after you’ve paid your bills. Lenders generally view a lower DTI as favorable.

36% to 49%: Opportunity to improve

You’re managing your debt adequately, but you may want to consider lowering your DTI. This may put you in a better position to handle unforeseen expenses. If you’re looking to borrow, keep in mind that lenders may ask for additional eligibility criteria.

50% or more: Take Action - You may have limited funds to save or spend

With more than half your income going toward debt payments, you may not have much money left to save, spend, or handle unforeseen expenses. With this DTI ratio, lenders may limit your borrowing options.

Collateral is a personal asset you own such as a car, a savings account, or a home.

Collateral is important to lenders because it offsets the risk they take when they offer you credit. Using your assets as collateral gives you more borrowing options — including credit accounts that may have lower interest rates and better terms.

If you have assets like equity in your home, you could potentially use your home equity as collateral to secure a loan — this may allow you to take advantage of a higher credit limit, better terms, and a lower rate. But, remember, when you use an asset as collateral, the lender may have the right to repossess it if the loan is not paid back.

Lenders evaluate the capital you have when you apply for large credit accounts like a mortgage, home equity, or personal loan account. Capital represents the assets you could use to repay a loan if you lost your job or experienced a financial setback.

Capital is typically your savings, investments, or retirement accounts, but it may also include the amount of the down payment you make when you purchase a home.

Capital matters because the more of it you have, the more financially secure you are — and the more confident the lender may be about extending you credit.

Conditions refer to a variety of factors that lenders may consider before extending credit. The conditions may include:

Conditions matter because they may impact your financial situation and ability to repay the loan.

Lenders may also consider your customer history when you apply for new credit. Since they may evaluate your overall financial responsibility, the relationship you've established with them can be valuable when you need more credit.

Explore resources to help you improve your credit and manage your debt.

You must be a Wells Fargo account holder of an eligible Wells Fargo consumer account with a FICO® Score available, and enrolled in Wells Fargo Online. Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts, but other consumer accounts may also be eligible. Contact Wells Fargo for details.

Please note that the score provided under this service is for educational purposes and may not be the score used by Wells Fargo to make credit decisions. Wells Fargo looks at many factors to determine your credit options; therefore, a specific FICO® Score or Wells Fargo credit rating does not guarantee a specific loan rate, approval of a loan, or an upgrade on a credit card.

Wells Fargo and Fair Isaac are not credit repair organizations as defined under federal and state law, including the Credit Repair Organizations Act. Wells Fargo and Fair Isaac don’t provide credit repair services or advice or assistance with rebuilding or improving your credit record, credit history, or credit rating.

This calculator is for educational purposes only and is not a denial or approval of credit.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

QSR-05212026-7171990.1.16

LRC-1124