Your financial health toolkit

Feel more confident about your finances

No matter where you are in your financial journey, Wells Fargo has the tools and resources to help you stay informed and in control.

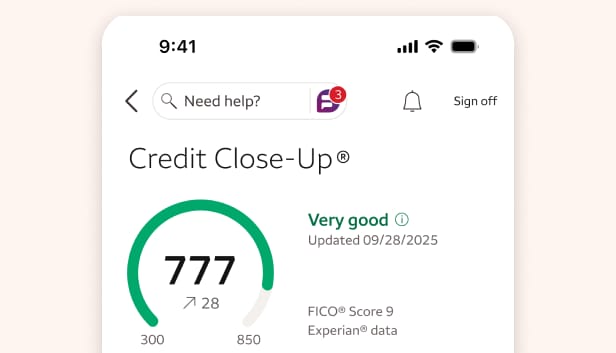

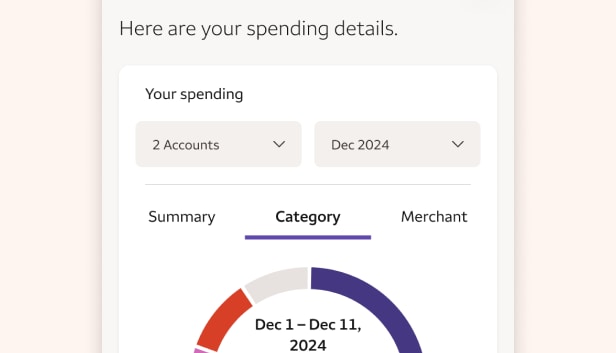

See where you stand

Plan for the future

LifeSync®

Your goals, your money — working together in real time. Available in the Wells Fargo Mobile® app.

Hands on Banking®

Wells Fargo’s free education tool offers practical tips on budgeting, managing credit, and making smart money choices.

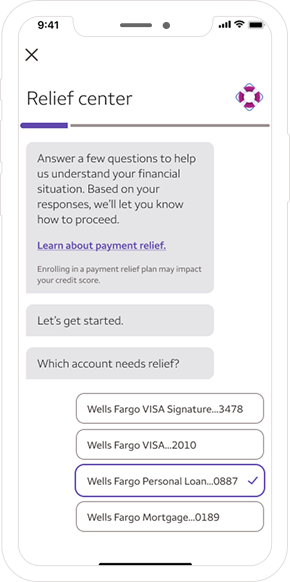

Get help when you need it

Payment assistance

If you’re struggling to make payments on a Wells Fargo account, Wells Fargo Assist℠ may be able to help.

Overdraft protection

Set up optional overdraft protection to avoid the inconvenience of declined transactions and overdrafts.

Connect with a credit counselor

They can help you find solutions that fit your personal financial needs.

Life’s unpredictable.

You must be a Wells Fargo account holder of an eligible Wells Fargo consumer account with a FICO® Score available, and enrolled in Wells Fargo Online. Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts, but other consumer accounts may also be eligible. Contact Wells Fargo for details. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

Please note that the score provided under this service is for educational purposes and may not be the score used by Wells Fargo to make credit decisions. Wells Fargo looks at many factors to determine your credit options; therefore, a specific FICO® Score or Wells Fargo credit rating does not guarantee a specific loan rate, approval of a loan, or an upgrade on a credit card.

Wells Fargo and Fair Isaac are not credit repair organizations as defined under federal and state law, including the Credit Repair Organizations Act. Wells Fargo and Fair Isaac don’t provide credit repair services or advice or assistance with rebuilding or improving your credit record, credit history, or credit rating.

Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier’s message and data rates may apply. Fargo is only available on the smartphone versions of the Wells Fargo Mobile® app.

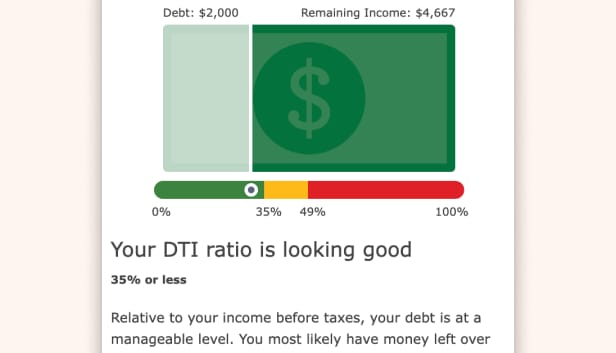

This calculator is for educational purposes only and is not a denial or approval of credit.

When you apply for credit, your lender may calculate your debt-to-income (DTI) ratio based on verified income and debt amounts, and the result may differ from the one shown here.

You do not need to share alimony, child support, or separate maintenance income unless you want it considered when calculating your result.

If you receive income that is nontaxable, it may be upwardly adjusted to account for the nontaxable status.

LifeSync® is available on the smartphone versions of the Wells Fargo Mobile® app. Additional device availability may vary. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come from a lower interest rate, a longer loan term, or a combination of both. By extending the loan term, you may pay more in interest over the life of the loan. By understanding how consolidating your debt benefits you, you will be in a better position to decide if it is the right option for you. New credit accounts are subject to application, credit qualification, and income verification.

Subject to account eligibility requirements.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Deposit products offered by Wells Fargo Bank, N.A. Member FDIC.

DT1-03082027-24-8448428-1.2