Certificados de depósito (CD)

Garantice sus ahorros y mantenga su tranquilidad

Depósito inicial mínimo: $2,500

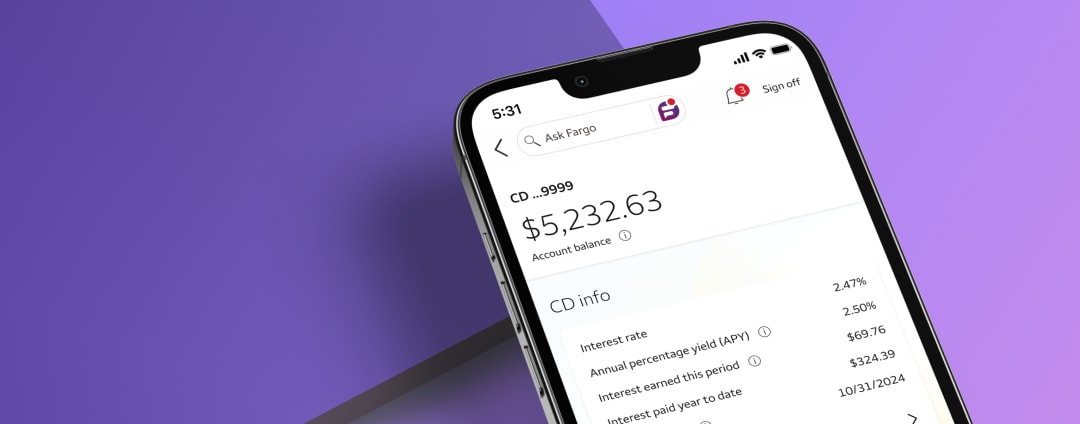

La imagen de la pantalla es simulada

Ventajas de una cuenta de certificado de depósito (CD)

de Wells Fargo

Mejores tasas de interés

Por lo general, los CD ofrecen tasas de interés más altas que otros productos de depósito

Retorno garantizado

La tasa de interés no cambia hasta el vencimiento del CD, de manera que sabrá exactamente cuánto obtendrá

Elija sus propios plazos

Elija la cantidad de tiempo que mejor se adapte a sus necesidades o metas de ahorro

Asegurados por la FDIC

Sus fondos están asegurados por la FDIC hasta los límites máximos aplicables

Tasas especiales de hoy para CD

Certificados de Depósito (CD) con Tasa Fija Estándar de hoy

3 meses

Tasas Estándar para Cuentas de Certificado de Depósito Fixed Rate

Las tasas no están disponibles en este momento. Intente de nuevo más tarde o llámenos al 1-800-869-3557.

$2,500 de depósito inicial mínimo

Podrían aplicarse penalidades por retiro anticipado

Existen otros plazos adicionales disponibles en una sucursal.

6 meses

Tasas Estándar para Cuentas de Certificado de Depósito Fixed Rate

Las tasas no están disponibles en este momento. Intente de nuevo más tarde o llámenos al 1-800-869-3557.

$2,500 de depósito inicial mínimo

Podrían aplicarse penalidades por retiro anticipado

Existen otros plazos adicionales disponibles en una sucursal.

1 año

Tasas Estándar para Cuentas de Certificado de Depósito Fixed Rate

Las tasas no están disponibles en este momento. Intente de nuevo más tarde o llámenos al 1-800-869-3557.

$2,500 de depósito inicial mínimo

Podrían aplicarse penalidades por retiro anticipado

Existen otros plazos adicionales disponibles en una sucursal.

Preguntas frecuentes sobre certificados de depósito (CD)

A la fecha de vencimiento

A la fecha de vencimiento, su CD se renovará de manera automática por el Plazo de Renovación indicado y la Tasa de Interés Estándar y Rendimiento Porcentual Anual (APY, por sus siglas en inglés) en vigencia a menos que haga un cambio en la fecha de vencimiento o durante el período de gracia de diez días calendario siguiente.

Aproximadamente 30 días antes del vencimiento, le enviaremos un aviso recordándole la fecha de vencimiento y el Plazo de Renovación programado. Comuníquese con Wells Fargo en la fecha de vencimiento o durante el período de gracia de diez días calendario para hacer cualquiera de los siguientes cambios: Renovar su CD por un plazo y una tasa más adecuados para usted, agregar fondos o generalmente realizar retiros, cerrar el CD.

Los intereses solo se pagan hasta la fecha de vencimiento si elige retirar los fondos o cerrar su CD.

Las Tasas de Interés Especiales

Las Tasas de Interés Especiales solo se aplican al plazo inicial.

A la fecha de vencimiento, los CD con Tasa de Interés Especial se renovarán de manera automática por el Plazo de Renovación indicado y la tasa de interés se restablecerá a la Tasa de Interés Estándar y Rendimiento Porcentual Anual en vigencia a la fecha de vencimiento a menos que haga un cambio en la fecha de vencimiento o durante un período de gracia de diez días calendario.

El rendimiento porcentual anual (APY, por sus siglas en inglés)

El rendimiento porcentual anual (APY, por sus siglas en inglés) es una tasa porcentual que refleja el monto total de intereses pagados en la cuenta, basada en la tasa de interés con capitalización diaria durante un período de 365 días.

Si usted recibe un estado de cuenta periódico, este incluirá el Rendimiento Porcentual Anual Devengado (APYE, por sus siglas en inglés) en su cuenta durante el período cubierto por el estado de cuenta.

APY actual para renovación

A la fecha de vencimiento, su CD con Tasa Fija Especial se renovará de manera automática por el Plazo de Renovación indicado y la Tasa de Interés Estándar y Rendimiento Porcentual Anual (APY, por sus siglas en inglés) en vigencia a menos que haga un cambio en la fecha de vencimiento o durante el período de gracia de siete días calendario siguiente.

Una Tasa de Interés por Relación

Una Tasa de Interés por Relación es una tasa de interés disponible en cuentas de ahorros o cuentas de certificado de depósito (CD) elegibles, cuando esas cuentas están vinculadas a una Cuenta de Cheques Prime Checking o a una Cuenta de Cheques Premier Checking.

¿Cómo fue su experiencia? Denos su opinión.

Se aplican términos y condiciones. Es posible que se apliquen las tarifas por servicio de mensajería y datos de su proveedor de telefonía móvil. Consulte el Contrato de Acceso por Internet de Wells Fargo para obtener más información.

Se aplican términos y condiciones. Se requiere realizar configuraciones para las transferencias a otras instituciones financieras de EE. UU., y la verificación podría tomar de 1 a 3 días laborables. Los clientes deben consultar a sus otras instituciones financieras de EE. UU. para obtener información acerca de los posibles cargos que cobran esas instituciones. Es posible que se apliquen las tarifas por servicio de mensajería y datos de su proveedor de telefonía móvil. Consulte el Contrato de Acceso por Internet de Wells Fargo para obtener más información.

El cargo mensual por servicio de los Certificados de Depósito (CD) de Tasa Fija de Wells Fargo es de $0. El depósito inicial mínimo para obtener un CD de Tasa Fija Estándar es de $2,500, a menos que se indique lo contrario. Los CD con Tasa de Interés Especial requieren un depósito inicial mínimo de $5,000, a menos que se indique lo contrario. El depósito inicial mínimo está sujeto a cambios, tal como se indica en wellsfargo.com/es/savings-cds/rates/.

Es posible que deba pagar una penalidad por retiro anticipado o una penalidad en virtud del Reglamento D si retira fondos de su cuenta antes de completar el plazo. Podrían aplicarse algunas excepciones. Las penalidades podrían reducir las ganancias de esta cuenta. El monto de la penalidad por retiro anticipado se calcula y se deduce de cualesquier intereses devengados. Si la penalidad es mayor que los intereses devengados, el monto de la penalidad restante se deducirá del capital de la cuenta.

La penalidad en virtud del Reglamento D equivale a los intereses simples de siete días sobre el monto retirado y se aplica a lo siguiente:

- Retiros realizados en el transcurso de siete días a partir de la apertura de la cuenta, incluido el día en que se abrió la cuenta.

- Retiros realizados durante el período de gracia, cuando se realizan depósitos adicionales durante el período de gracia y el retiro excede el monto del saldo del CD vencido.

- Retiros realizados en el transcurso de siete días desde cualquier retiro anterior cuando no se aplique la penalidad por retiro anticipado del Banco.

Aparte de la penalidad en virtud del Reglamento D descrita arriba, todo el dinero que retire del CD antes de la finalización de su plazo estará sujeto a una penalidad por retiro anticipado que se basa en la duración del plazo del CD. Si su plazo es de:

- Menos de 90 días (o menos de 3 meses), la penalidad es equivalente a los intereses de 1 mes,

- 90 a 365 días (o 3 a 12 meses), la penalidad es equivalente a los intereses de 3 meses,

- Más de 12 meses hasta 24 meses, la penalidad es equivalente a los intereses de 6 meses, o

- Más de 24 meses, la penalidad es equivalente a los intereses de 12 meses.

Consulte el Programa de Cargos e Información de la Cuenta al Consumidor y el Contrato de la Cuenta de Depósito para obtener información adicional sobre la cuenta al consumidor.

Una Tasa de Interés por Relación es variable y está sujeta a cambio en cualquier momento sin aviso, lo que incluye establecer la tasa de interés equivalente a la Tasa de Interés Estándar o en cero (0.00%), lo que podría cambiar el Rendimiento Porcentual Anual (APY, por sus siglas en inglés) por Relación. Para los CD, el cambio se producirá en el momento de la renovación. Para recibir la Tasa de Interés por Relación y el APY por Relación, la cuenta de ahorros elegible o el CD elegible deberá permanecer vinculada a una cuenta de cheques Prime Checking, una cuenta de cheques Premier Checking o a una cuenta de cheques Private Bank Interest Checking. Al vincular la cuenta, o cambiar de una cuenta vinculada a una cuenta de ahorros elegible, podría demorar hasta dos días laborables para que la Tasa de Interés por Relación se aplique a su cuenta de ahorros eligible. Los CD deberán vincularse en el momento de la apertura de la cuenta y en cada renovación. Si la cuenta de cheques se cierra por la razón que sea o si la cuenta de ahorros elegible o el CD eligible es desvinculada, la cuenta revertirá a la Tasa de Interés Estándar correspondiente y vigente en esa fecha; para los CD, este cambio se producirá en el momento de la renovación. Cualquier Tasa de Interés Especial no se vencería hasta la fecha de vencimiento de dicha Tasa de Interés Especial.

Las cuentas de Certificado de Depósito (CD) con una Tasa de Interés Especial requieren un depósito inicial mínimo de $5,000, a menos que se indique lo contrario. Las cuentas de fondos públicos no son elegibles para estas ofertas. Las Tasas de Interés Especiales solo se aplican al plazo inicial. A la fecha de vencimiento, las Cuentas de Certificado de Depósito (CD) con una Tasa de Interés Especial se renovarán de manera automática por el Plazo de Renovación arriba indicado, a la tasa de interés y al Rendimiento Porcentual Anual (APY, por sus siglas en inglés) en vigencia en la fecha de vencimiento para cuentas de certificado de depósito (CD) que no estén sujetas a una Tasa de Interés Especial, a menos que el Banco le haya notificado lo contrario. El Banco podrá limitar el monto que usted puede depositar en este producto a un total de $2.5 millones.

Las cuentas de Certificado de Depósito (CD) con una Tasa de Interés Estándar requieren un depósito inicial mínimo de $2,500, a menos que se indique lo contrario.

El cargo mensual por servicio para los Certificados de Depósito (CD) con Tasa Fija de Wells Fargo es de $0. El depósito inicial mínimo para un Certificado de Depósito (CD) con Tasa Fija Estándar es de $2,500, a menos que se indique lo contrario. El depósito inicial mínimo está sujeto a cambio, como se muestra en wellsfargo.com/es/savings-cds/rates/.

Es posible que deba pagar una penalidad por retiro anticipado o una penalidad en virtud del Reglamento D si retira fondos de su cuenta antes de completar el plazo. Podrían aplicarse algunas excepciones. Las penalidades podrían reducir las ganancias de esta cuenta. El monto de la penalidad por retiro anticipado se calcula y se deduce de cualesquier intereses devengados. Si la penalidad es mayor que los intereses devengados, el monto de la penalidad restante se deducirá del capital de la cuenta.

La penalidad en virtud del Reglamento D equivale a los intereses simples de siete días sobre el monto retirado y se aplica a lo siguiente:

- Retiros realizados en el transcurso de siete días a partir de la apertura de la cuenta, incluido el día en que se abrió la cuenta.

- Retiros realizados durante el período de gracia, cuando se realizan depósitos adicionales durante el período de gracia y el retiro excede el monto del saldo del CD vencido.

- Retiros realizados en el transcurso de siete días posteriores a cualquier otro retiro anterior cuando no se aplique la penalidad por retiro anticipado del Banco.

Aparte de la penalidad en virtud del Reglamento D descrita arriba, todo el dinero que retire de su CD antes de la finalización de su plazo estará sujeto a una penalidad por retiro anticipado basada en la duración del plazo de su CD. Si su plazo es de:

- Menos de 90 días (o menos de 3 meses), la penalidad es equivalente a los intereses de 1 mes,

- Entre 90 y 365 días (o entre 3 y 12 meses), la penalidad es equivalente a los intereses de 3 meses,

- Más de 12 meses hasta 24 meses, la penalidad es equivalente a los intereses de 6 meses, o

- Más de 24 meses, la penalidad es equivalente a 12 meses de intereses.

Consulte el Programa de Cargos e Información de la Cuenta al Consumidor y el Contrato de la Cuenta de Depósito para obtener información adicional sobre la cuenta al consumidor.

Tasas de interés actuales aplicables a depósitos entre -

Los Rendimientos Porcentuales Anuales (APY, por sus siglas en inglés) y las Tasas de Interés que se indican se ofrecen para las cuentas aceptadas por el Banco y están vigentes para las fechas señaladas arriba, a menos que se indique lo contrario. Las Tasas de Interés están sujetas a cambio sin aviso. [Las tasas podrían variar según la ubicación.]

Las tasas de los Certificados de Depósito (CD) son fijas durante el plazo de la cuenta. Podría imponerse una penalidad por retiro anticipado de un CD. Para los CD, los intereses comienzan a acumularse el día laborable en que usted deposita partidas que no sean en efectivo, como los cheques. Las penalidades, incluidas las penalidades por retiro anticipado, podrían reducir las ganancias. El monto de la penalidad por retiro anticipado se calcula y se deduce de cualesquier intereses devengados. Si la penalidad es mayor que los intereses devengados, el monto de la penalidad restante se deducirá del capital de la cuenta.

Los intereses se capitalizan diariamente. El pago de los intereses de los CD se basa en el plazo:

- Para plazos de menos de 12 meses (365 días), los intereses se podrían pagar en forma mensual, trimestral, semestral o al vencimiento (al finalizar el plazo).

- Para plazos de 12 meses o más, los intereses se podrían pagar en forma mensual, trimestral, semestral o anual.

Las tasas de los CD están sujetas a cambio en cualquier momento y no están garantizadas hasta que se abra el CD.

Los retiros anticipados podrían estar sujetos a la penalidad en virtud del Reglamento D o a la penalidad por retiro anticipado. Podrían aplicarse algunas excepciones.

La penalidad en virtud del Reglamento D equivale a los intereses simples de siete días sobre el monto retirado y se aplica a lo siguiente:

- Retiros realizados en el transcurso de siete días a partir de la apertura de la cuenta, incluido el día en que se abrió la cuenta.

- Retiros realizados durante el período de gracia, cuando se realizan depósitos adicionales durante el período de gracia y el retiro excede el monto del saldo del CD vencido.

- Retiros realizados en el transcurso de siete días desde cualquier retiro anterior cuando no se aplique la penalidad por retiro anticipado del Banco.

Aparte de la penalidad en virtud del Reglamento D descrita arriba, todo el dinero que retire del CD antes de la finalización de su plazo estará sujeto a una penalidad por retiro anticipado que se basa en la duración del plazo del CD. Si su plazo es de:

- Menos de 90 días (o menos de 3 meses), la penalidad es equivalente a los intereses de 1 mes

- 90 a 365 días (o 3 a 12 meses), la penalidad es equivalente a los intereses de 3 meses

- Más de 12 meses hasta 24 meses, la penalidad es equivalente a los intereses de 6 meses o

- Más de 24 meses, la penalidad es equivalente a los intereses de 12 meses.

Consulte el Programa de Cargos e Información de la Cuenta al Consumidor y el Contrato de la Cuenta de Depósito para obtener información adicional sobre la cuenta al consumidor.

Wells Fargo Bank, N.A. Miembro FDIC.

DT1-07232026-12-8237244-1.1