Plan for your financial future

Be ready for what’s next

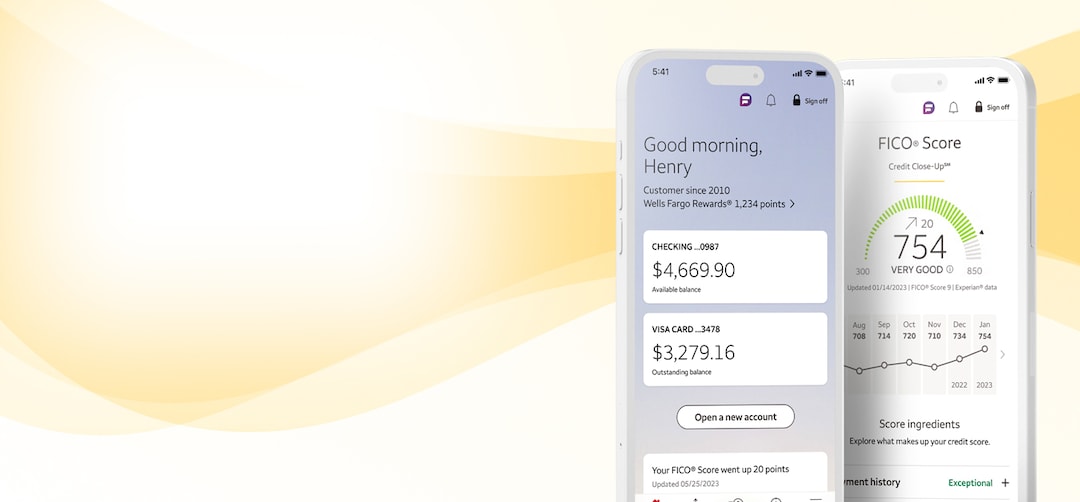

You've got the tools you need with mobile and online banking.

Download our appBuild your future with financial tools and services

Monitor your money

- Plan for life events — expected and not

- Build your credit

- Get ready for big purchases

Track your spending

- Design a personalized budget

- Track every dollar you spend

- Create a savings plan

Check your credit score

- Get access to your FICO® Score

- Receive credit monitoring alerts

- Review your Experian® credit report

Learn more about your debt

- Compare what you owe to what you earn

- See if you’re comfortable with your debt

- Consider if you want to borrow money

Explore your investment options

- Invest on your own with WellsTrade®

- Automate with Intuitive Investor®

- Work with a Financial Advisor

Your FICO® Score

Take a closer look at your financial situation with info from your Experian® credit report and FICO® Score. A high score may help you qualify for a loan or get a lower interest rate.

Knowing your credit score and reviewing your credit report can help you make better financial decisions — for today and for tomorrow.

Mobile and online banking when you need them

Manage your money on the Wells Fargo Mobile® app when you’re on the go. And use Wells Fargo Online® when it’s more convenient to be on your computer.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC (WFCS) and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

How was your experience? Give us feedback.

You must be a Wells Fargo account holder of an eligible Wells Fargo consumer account with a FICO® Score available, and enrolled in Wells Fargo Online. Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts, but other consumer accounts may also be eligible. Contact Wells Fargo for details.

Please note that the score provided under this service is for educational purposes and may not be the score used by Wells Fargo to make credit decisions. Wells Fargo looks at many factors to determine your credit options; therefore, a specific FICO® Score or Wells Fargo credit rating does not guarantee a specific loan rate, approval of a loan, or an upgrade on a credit card.

Wells Fargo and Fair Isaac are not credit repair organizations as defined under federal and state law, including the Credit Repair Organizations Act. Wells Fargo and Fair Isaac don’t provide credit repair services or advice or assistance with rebuilding or improving your credit record, credit history, or credit rating.

WellsTrade offers the following account types: standard brokerage, traditional/Roth/SEP/inherited IRAs, education savings accounts, custodial accounts, trust accounts, business accounts, and Qualified Retirement Plans. Some of these must be opened over the phone at 1-877-573-7997.

The Intuitive Investor program is not designed for excessively traded or inactive accounts and is not appropriate for all investors. Please carefully review the Wells Fargo Advisors advisory disclosure document for a full description of our services. The minimum account size for this program is $500.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Screen images are simulated. Features, functionality, and specifications appearing in those images may change without notice.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Wells Fargo Bank, N.A. Member FDIC.

PM-09202026-7768082.1.1

LRC-0325