Auto financing

Ask your dealer about Wells Fargo auto loans

Our nationwide network of nearly 11,000 dealerships is ready to help.

Auto loans: what to know

Financing a car can be overwhelming. Understanding the common variables of auto loans makes the process easier.

Interest rate

Confirm the annual percentage rate (APR) of your auto loan and determine if it has a fixed rate (the monthly payment and interest rate remain the same).

Term length

Car loans generally range from 36 to 72 months. Longer terms can lower your monthly auto loan payment but can also cost you more over the life of the loan.

Total amount financed

Be sure you understand the total amount on your loan documents and what it includes. Often, state and local taxes, or aftermarket products such as an extended warranty, can be part of your loan amount.

Monthly payment amount

The monthly payment amount includes the loan's principal and interest as well as any additional products or services you may finance. Make sure your payment fits your budget.

Increase your likelihood of credit approval

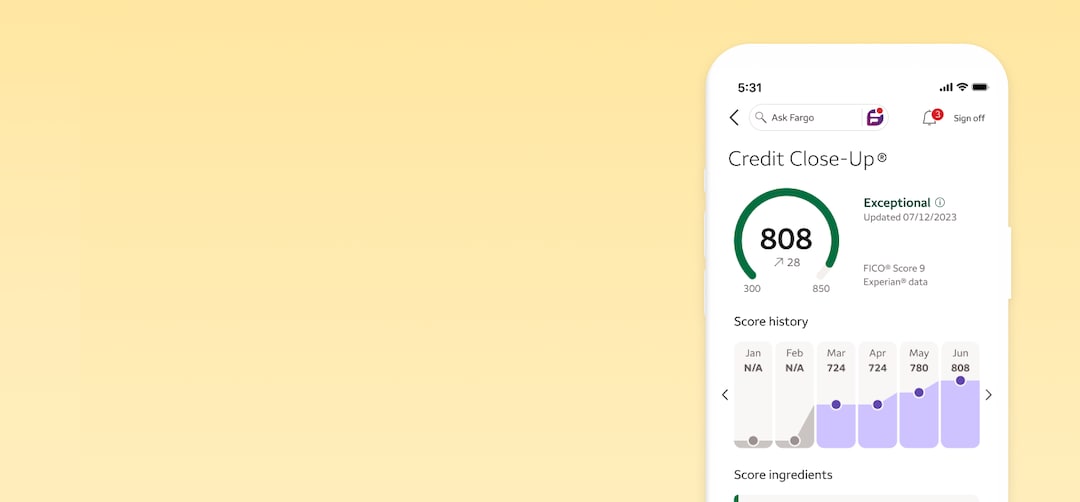

Track your credit score with Credit Close-Up®,

Knowing your credit score can help you take a proactive approach to auto financing.

- Understand how your credit score can vary over time and why.

- Make a plan for improving your credit score, if necessary.

- Set alerts to find out when new info is added to your credit report.,

Before you buy

Think about how you'll use your vehicle, considering things like interior space, car size, maintenance, and gas mileage.

Consult car-buying guides like Kelley Blue Book or Edmunds to learn about features and fair market values of the vehicles that interest you.

Consider costs beyond the sticker price, including fuel costs, registration fees, maintenance, insurance, and repairs.

How to evaluate new and used vehicles

Find a vehicle you love

Aim for a new or used car you really want that's in your price range. If there’s a color or feature you're interested in, just ask! Dealerships often have the ability to locate and sell models not currently in their inventory.

Inspect and test drive

Before you buy, examine the vehicle during daylight hours to discover any blemishes or damage. Have it inspected by a trusted mechanic or use a service like Carfax.com to understand its history, including any involvement in accidents. Finally, test drive the vehicle in different environments and conditions to make sure you feel comfortable.

Explore incentives

Ask about current and future promotions that may lower the price of your vehicle. Make sure you understand any offer from the dealer and read the fine print for incentives before finalizing your auto loan.

Ask about warranties

Many new and used car purchases include warranties. Consider the warranty options available to you and any costs associated with them. Make sure you understand what the warranty does and doesn't cover before you buy a vehicle.

Answers to auto financing questions

Additional resources

How was your experience? Give us feedback.

Sign-up may be required. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

You must be a Wells Fargo account holder of an eligible Wells Fargo consumer account with a FICO® Score available, and enrolled in Wells Fargo Online. Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts, but other consumer accounts may also be eligible. Contact Wells Fargo for details. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

Please note that the score provided under this service is for educational purposes and may not be the score used by Wells Fargo to make credit decisions. Wells Fargo looks at many factors to determine your credit options; therefore, a specific FICO® Score or Wells Fargo credit rating does not guarantee a specific loan rate, approval of a loan, or an upgrade on a credit card.

Wells Fargo and Fair Isaac are not credit repair organizations as defined under federal and state law, including the Credit Repair Organizations Act. Wells Fargo and Fair Isaac don’t provide credit repair services or advice or assistance with rebuilding or improving your credit record, credit history, or credit rating.

Terms and conditions apply. Mobile carrier's message and data rates may apply. See Wells Fargo's Online Access Agreement for more information.

Online Statements require Adobe® Acrobat® PDF reader. The length of time Online Statements are available to view and download varies depending on the product: up to 12 months for auto loans; up to 2 years for credit cards, home equity lines of credit, and personal loans and lines of credit; and up to 7 years for deposit accounts, home mortgage accounts, and trust and managed investment accounts. The length of time the specific product statements are available online can be found in Wells Fargo Online® in Statements & documents. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier’s message and data rates may apply.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

QSR-12022026-8027176.1.1

LRC-0925