Individual Retirement Accounts (IRAs) were created to give people a tax-advantaged way to save for retirement. The biggest advantage is not having to pay taxes on investment earnings (gains, interest, or dividends) while your assets are in the account. The earlier you start to save in an IRA, the more time you have for those savings to potentially grow through the power of tax-advantaged compounding.

Tax advantages increase earning potential

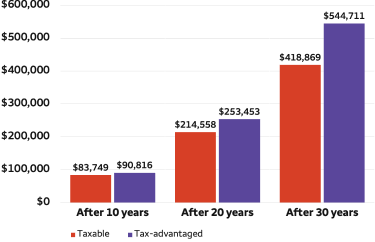

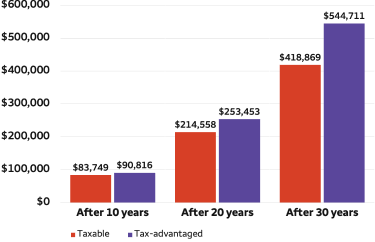

IRAs offer the potential for growth in a tax-advantaged account. Over time, that can make a significant difference in your retirement savings. Let’s look at a hypothetical example that starts with a contribution of $7,000 a year, at a 24% cumulative tax rate, and a 6% annual fixed rate of return.

Hypothetical value of $7,000 in annual contributions over 30 years

In a taxable account, the value would be $83,749 after 10 years, $214,558 after 20 years, and $418,869 after 30 years. In a tax-advantaged account, the value would increase to $90,816 after 10 years, $253,453 after 20 years, and $544,711 after 30 years.

This hypothetical example assumes an annual fixed rate of return of 6% and a 24% cumulative tax rate with $7,000 annual contributions and taxes in the taxable account paid annually. This example does not consider the advantage of deductible contributions. The growth of the tax-advantaged account is before-tax and distributions are subject to an ordinary income tax rate and may be subject to a 10% additional tax if taken prior to age 59 1/2. This hypothetical example does not represent the returns of any particular investment and should not be used to predict or project performance. There is no guarantee you will earn 6% on investments and your account value may fluctuate over time. Investing involves risk, including the possible loss of principal. It assumes all earnings are reinvested and does not include transaction costs, fees, or expenses associated with the account or any individual investments made in the account.

If the potential costs, fees, or expenses of the account and hypothetical investment had been reflected, the ending value of the tax-deferred investment could be lower.

Lower tax rates on capital gains and dividends could make the investment return for the taxable investment more favorable, thereby reducing the difference in performance between the accounts shown.

Changes in tax rates and tax treatment of investment earnings may impact the comparative results. You should consider your personal investment horizon and income tax bracket, both current and anticipated, when making an investment decision as these may further impact the results of the comparison. Wells Fargo does not provide tax or legal advice. Please see your tax and legal advisors for guidance.

Consider saving for retirement in an IRA if:

- You don't have access to a qualified employer sponsored retirement plan (QRP), such as a 401(k), 403(b), or governmental 457(b) plan.

- You are a non-working spouse, file a joint tax return, and would like to save for retirement.

- You're already saving in your QRP but would like to supplement your retirement savings.

- You're changing jobs or retiring and want to know the distribution options for your QRP.

- You have contributed the maximum amount to your QRP and would like to save an additional amount in an IRA.

Need more information? Review our IRA Frequently Asked Questions.

Choose between two types of IRAs

There are two main types of IRAs: Traditional and Roth. Both types of IRAs offer investment flexibility, tax advantages, and the same contribution limits. For more information about the differences between the two types of IRAs, including details about eligibility, visit the Traditional vs. Roth section of our IRA Center. Also, find out more about converting to a Roth IRA .

Wells Fargo has the right IRA for you

Wells Fargo can support you in your retirement planning process by providing the guidance needed to make informed choices. We begin with manageable steps that carefully balance your long- and short-term needs, working with you to design a plan to match your vision for tomorrow.

We have a variety of ways you can work with us. Get started by choosing an account.

We’re here for small business

Wells Fargo understands the unique investment and retirement challenges of business owners and the self-employed. Whether you need IRA information, a retirement plan for you and your employees, or a business valuation, you can count on us to address your financial needs. We have retirement planning ideas designed specifically for you and your business.

Investment and Insurance Products are: - Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC (WFCS) and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

Income tax will apply to Traditional IRA distributions that you have to include in gross income. Qualified Roth IRA distributions are not included in gross income. Roth IRA distributions are generally considered “qualified” provided a Roth IRA has been funded for more than five years and the owner has reached age 59½ or meets other requirements. Both Traditional and Roth IRA distributions may be subject to an IRS 10% additional tax for early or pre-59 ½ distributions.

Wells Fargo and Company and its Affiliates do not provide tax or legal advice. This communication cannot be relied upon to avoid tax penalties. Please consult your tax and legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your tax return is filed.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC (WFCS). Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Wells Fargo Destination® IRAs are available through Wells Fargo Bank, N.A.

Information published by Wells Fargo Bank, N.A., Wells Fargo Advisors, or one of its affiliates as part of this website is published in the United States and is intended only for persons in the United States.

Deposit products offered by Wells Fargo Bank, N.A. Member FDIC.

PM-08042026-6737841.14.21

Sign On

Sign On