Empower your financial vision

Grow your legacy with Private Wealth

Preserving wealth, fostering growth, and

powering legacies for generations

Investing strategies and insights

Investment Strategy update

Weekly market insights and possible impacts on investors from Wells Fargo Investment Institute.

Scams are on the rise. Protect yourself.

Recognize the tell-tale signs of scams so you won’t be the next victim.

Retirement strategies

Whether you're close to retirement or years away, we can help you build a retirement plan to help meet your goals.

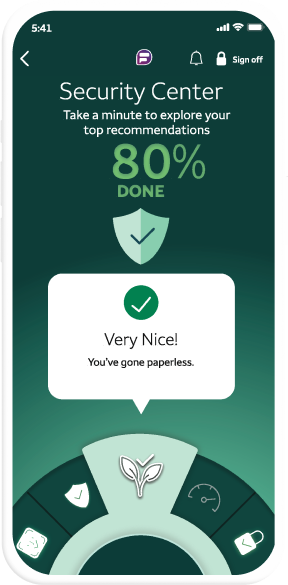

Boost your protection

Get the latest security features and tips in the newly redesigned Security Center, only in the Wells Fargo Mobile® app.

Benefits and resources

Make your money work for you

Understand the importance of cash flow planning and how it can help you stay on track.

Understanding digital assets

Wells Fargo Investment Institute provides an overview of what digital assets are and their importance to the digital future.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

$0 per trade is applicable to commissions for online and automated telephone trading of stocks and exchange-traded funds (ETFs). For stock and ETF trades placed with an agent over the telephone, a $25 agent-assisted trading fee is charged. Each trade order will be treated as a separate transaction subject to commission. An order that executes over multiple trading days may be subject to additional commission. One commission will be assessed for multiple trades, entered separately, that execute on the same day, on the same side of the market. Other fees and commissions apply to a WellsTrade account. For complete information on fees and commissions, refer to the WellsTrade Account Commissions and Fees Schedule. Schedule subject to change at any time.

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC (WFCS) and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

Wells Fargo Investment Institute, Inc., (WFII) is a registered investment adviser and wholly owned subsidiary of Wells Fargo Bank, N.A., a bank affiliate of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Private Wealth is an exclusive and personalized service and product offering for qualifying clients of Wealth & Investment Management (WIM). WIM offers financial products and services through bank and brokerage affiliates of Wells Fargo & Company. Bank products and services are available through Wells Fargo Bank, N.A.

Wells Fargo Bank, N.A. ("the Bank") offers various banking, advisory, fiduciary and custody products and services, including discretionary portfolio management. Wells Fargo affiliates, including Financial Advisors of Wells Fargo Advisors, may be paid an ongoing or one-time referral fee in relation to clients referred to the Bank. In these instances, the Bank is responsible for the day-to-day management of any referred accounts.

Wells Fargo and Company and its Affiliates do not provide tax or legal advice. This communication cannot be relied upon to avoid tax penalties. Please consult your tax and legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your tax return is filed.

Screen images are simulated. Features, functionality, and specifications appearing in those images may change without notice.

Android, Google Play, Chrome, Pixel and other marks are trademarks of Google LLC.

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iCloud Keychain, iPad, iPad Pro, iPhone, iTunes, Mac, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Wallet is a trademark of Apple Inc. App Store is a service mark of Apple Inc.

[PM]-07232027-5126330

DT1-07232027-18-8729691-1.1