By Brad Rubin, Sector Manager, Specialty Crops, Wells Fargo Agri-Food Institute

Americans love tomatoes whether in a salad, in salsa, or in a sauce over pasta. Each year, the average American eats more than 31 pounds of tomatoes per capita, with three-quarters consumed in processed form such as paste, sauce, and ketchup. While demand for the popular vegetable continues to grow, tomatoes, like so many crops, have not been spared the effects of extreme weather, regulations, and economic challenges. As a result, the upfront cost for growers and industry processors to harvest and bring tomatoes to market continues to increase. We expect those expenses will lead to higher costs for consumers at grocery stores and restaurants. So, you may have to dig deeper in your pocket to pay for your next pizza.

Americans love tomatoes whether in a salad, in salsa, or in a sauce over pasta. Each year, the average American eats more than 31 pounds of tomatoes per capita, with three-quarters consumed in processed form such as paste, sauce, and ketchup. While demand for the popular vegetable continues to grow, tomatoes, like so many crops, have not been spared the effects of extreme weather, regulations, and economic challenges. As a result, the upfront cost for growers and industry processors to harvest and bring tomatoes to market continues to increase. We expect those expenses will lead to higher costs for consumers at grocery stores and restaurants. So, you may have to dig deeper in your pocket to pay for your next pizza.

Despite headwinds, the industry is adapting. The following analysis offers a look at the sector’s top challenges and opportunities, including insights from my colleague Amber Neimeyer, one of Wells Fargo’s Commercial Banking relationship managers who works directly with tomato processors in California.

The impact of the elements

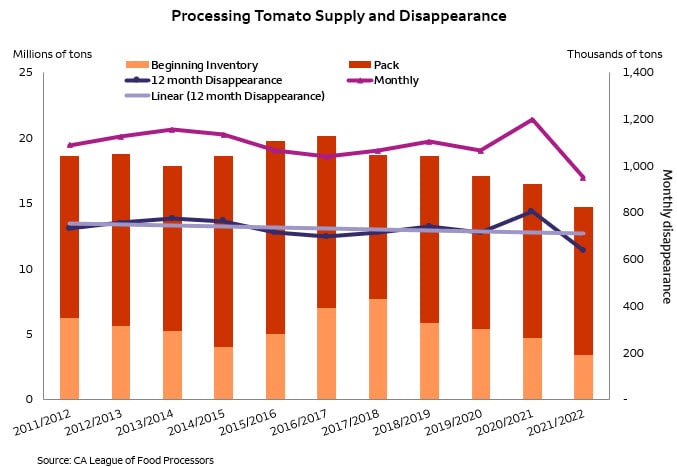

California produces almost 95% of tomatoes grown for processing in the U.S. and one-third of the world’s production. Drought, extreme heat, and reduced acreage from competing specialty crops have hindered the California tomato growing season, causing shifts in production yields and inventory as depicted in the below chart. Despite recent rains, the state remains in drought. Unlike the rest of the country, California growers are also under considerable water regulation, namely the Sustainable Groundwater Management Act (SGMA).

Since the passage of the SGMA in 2014, the California agricultural industry has been under continuous pressure and scrutiny for water usage to grow everyday fruits and vegetables. This is not to suggest the industry has been negligent with its water allocation, rather that water availability has diminished because of droughts, environmental protection regulations, and population growth. To grow, harvest, and distribute commodities, producers need access to water, soil, nutrients, labor, and transportation. This is especially true for tomatoes.

When the California legislature passed SGMA, it hoped to reestablish California’s water table levels which were reaching precarious levels. The idea was to let the annual rain and snow accumulation determine how much water could be safely sourced by measuring groundwater levels at the end of the wet season, and then provide growers their water allotments, determining how much planting could be done per season. Certainly, maintaining a healthy groundwater supply is a priority for consumers. However, there is no simple solution, and growers felt the impact. Tomatoes have a 60 to 100-day growing season, and if growers don’t know how much they’ll be growing until right before the start of planting, they won’t know what materials to order, who to hire, and how to contract. All these factors can lead to increased costs.

“We should expect reduced acres in nearly all commodities grown in California,” says Amber Neimeyer, Relationship Manager within Wells Fargo’s Agribusiness, Food and Hospitality Division. “Despite these challenges, we’re seeing producers and processors develop budgets and seek solutions that ensure they have adequate water supplies and access to capital as they are, in some cases, seeing double digit price increases on the input side.”

Responding with strategy

The American tomato industry is resilient and innovative, and the challenge to identify new methodologies is not left on their shoulders alone. A variety of industries across the state are seeking solutions. The University of California Division of Agriculture and Natural Resources proposes the following strategies for managing and coping with drought for processing tomato growers:

- Reduce irrigated acreage to match water supply

- Fully-irrigate during the first part of the crop season followed by little or no irrigation for remainder of the season

- Using drip irrigation

- Using furrow irrigation

- Early season irrigation

- Replace surface water with groundwater where possible

“Tomato growers have been implementing improved irrigation methods to combat possible drought and improve yields,” says Amber.

With 2022 offering a shorter tomato growing season than expected, coupled with demand for planted acres in 2023, inventory levels will continue to be short, likely keeping prices elevated for the next few years until inventory levels stabilize. With current inflation rates, the increase in cost of goods has an impact on businesses that are not vertically integrated. “Because of declining inventory and rising demand, higher prices would be present regardless of the worldwide economy,” says Amber. “Growers are facing drought. This coupled with the SGMA regulations in key growing regions, primarily the California’s South San Joaquin Valley, will have the inevitable result of acres being taken out of production.”

Financial implications

The tomato grower price – $105/ton in 2022 and expected to reach $125-130/ton in 2023 – is likely to continue incentivizing producers to plant at least some tomatoes, as grower prices have increased materially across all row/field crops including rice, cotton, and wheat. Crops harvested this past summer experienced a 25% cost increase from the product to the processors and likely will reach an overall increase of 50% for canners and processors between 2021 and 2023. Producers who are paying attention to per-acre profit will be making decisions based on these economics as crop input costs have gone up materially as well, and play into the overall margin per acre.

From November 2021 to November 2022, the USDA recorded the Consumer Price Index (CPI) for all foods increased by 9.5% and 10.5%, with food at home prices estimated increase between 11-12% and food-away from home prices between 7-8% increase. Wholesale prices for vegetables in November 2022 increased by 38.1%,8 which is expected to put further pressure on retail prices in the coming months. For the consumer, this could result in an additional 3-4% increase at the supermarket and 4-5% increase in dining out.

Tomatoes tomorrow

Consumers are changing their buying habits. Determining which brands to purchase is no longer a decision made solely by preference. To maintain budget, 46% of consumers forego their favorite brands, and 43% seek out sales to offset cost. Fortunately, for the American palate, tomatoes and tomato products are used by a wide array of manufacturers and can be found across an extensive selection of brands.

Tomatoes, whether fresh or processed, are expected to remain on the plate, even if the tomato sauce spreads thin, so to speak. Expert Market Research expects the global tomato processing market to grow from 80 million tons in 2022 to 99 million tons in 2028, and we have no doubt the industry will adapt. Indeed, adapting and improving are hallmark characteristics of American agribusiness. And, for American tomato growers and processors, preparing for the climate, the economy, and the consumer is simply a way of life.

Brad Rubin is the Sector Manager for Specialty Crops within Wells Fargo’s Agri-Food Institute, and focuses on fruits and vegetables. Brad joined Wells Fargo in January 2018, having formerly worked as Chief Marketing Officer for iD Tech. Prior, he was Vice President of Operations for Kibo Commerce, an enterprise e-commerce provider. Before Kibo Commerce, Brad served as the Director of Global Operations at TransUnion and managed customer operations globally for the credit bureau’s direct-to-consumer business.

Brad Rubin is the Sector Manager for Specialty Crops within Wells Fargo’s Agri-Food Institute, and focuses on fruits and vegetables. Brad joined Wells Fargo in January 2018, having formerly worked as Chief Marketing Officer for iD Tech. Prior, he was Vice President of Operations for Kibo Commerce, an enterprise e-commerce provider. Before Kibo Commerce, Brad served as the Director of Global Operations at TransUnion and managed customer operations globally for the credit bureau’s direct-to-consumer business.

Brad holds a Bachelor of Science degree in Industrial Technology from California Polytechnic State University, San Luis Obispo.

Sign On

Sign On