By Michael Swanson, Ph.D., Chief Agricultural Economist, Wells Fargo Agri-Food Institute

With two-thirds of U.S. apples produced in Washington state, this state's apple growers are often wondering what the consumer thinks about the value of their product. During a recent visit with Washington apple growers, I was able to share that the U.S. consumer is getting a better value for their apples relative to their wages. And this is true of both conventional and organic varieties.

With two-thirds of U.S. apples produced in Washington state, this state's apple growers are often wondering what the consumer thinks about the value of their product. During a recent visit with Washington apple growers, I was able to share that the U.S. consumer is getting a better value for their apples relative to their wages. And this is true of both conventional and organic varieties.

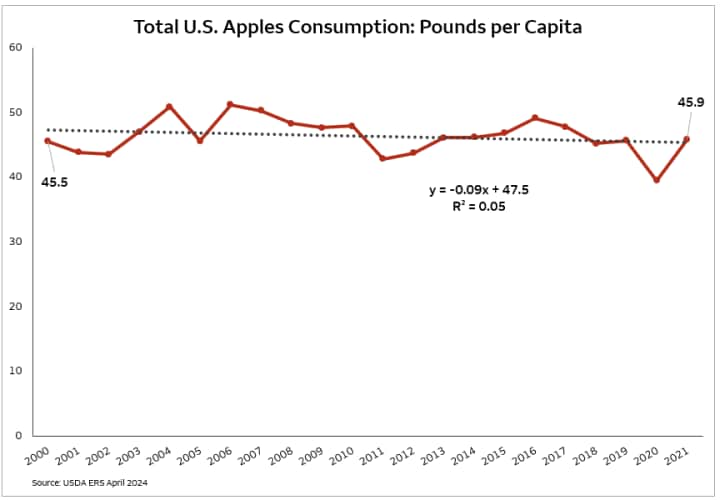

This discussion continues the theme that while the U.S. consumer continues to see the absolute retail price of apples rising, they also have more purchasing power thanks to higher wages and personal income. Consumers' overall consumption of apples has remained constant for the last couple of decades, but this isn't true of the fruit category as a whole. When looking at the total fruit category and the fresh equivalent per pound, consumption of fruit has fallen more than two pounds per year since 2000, resulting in a reduction in fruit consumption of nearly 50 pounds per consumer across the last 23 years. Most of this reduction has come in the fruit juice category since water, sports drinks, and carbonated beverages have stolen market share. However, viewed by themselves, apples have not seen this erosion in either fresh fruit or juice thanks to the value the consumer sees. Once again, the consumer has realized benefits from the intense efforts of the producers and packers.

The careful science and investment at the orchard level brings higher yields per acre and better tasting varieties. These apples get picked faster and are handled more efficiently in route to the supermarket shelves by the packer and wholesaler. With intense price competition, never-ending improvement at every step of the process allows only the most dedicated to manage change in order to stay in the business.

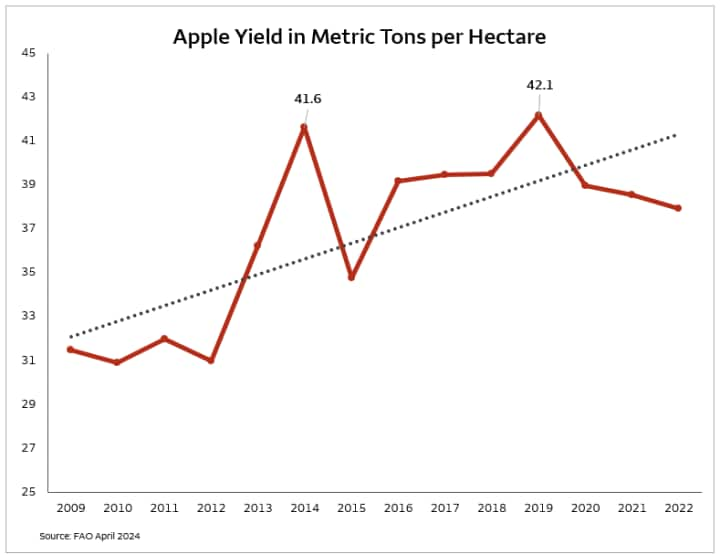

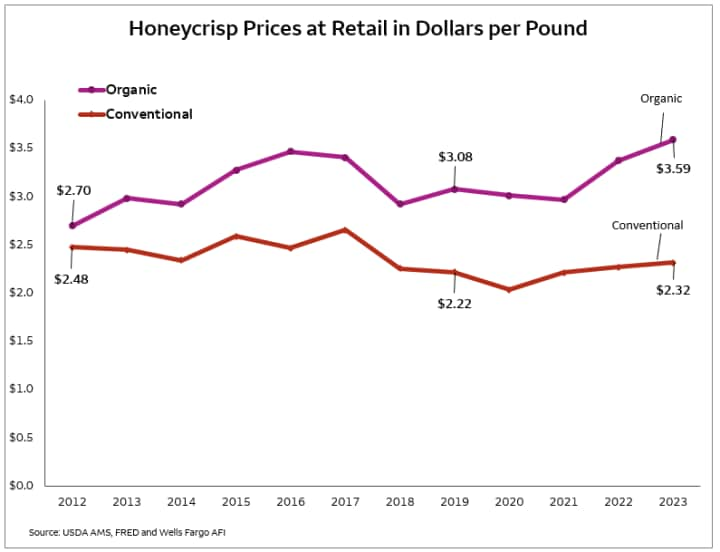

While all this behind-the-scenes hustle and bustle takes place, the consumer strolls through the supermarket contemplating their options. The recent run up in the Consumer Price Index (CPI) for food both at home and away from home has taken the consumer by surprise and has upset their expectations. The following graph shows that retail apple prices for both the conventional and organic Honeycrisp variety have risen from the 2019 pre-COVID price shock. However, we need to consider a couple of factors. First, 2019 was a fantastic growing season for apples, setting an all-time record at 42.1 metric tons per hectare, and that strong crop depressed retail apple prices right before the supply chain was unsettled by COVID. Second, much of the cost absorbed by the consumer comes after the fruit is picked in the orchard. According to the USDA, on average, approximately 80% of the food cost is added after the farm and ranch level. This includes food processing, packaging, wholesaling, retailing, and a host of other costs that transform raw products into consumer-ready foods.

For apples, it is the sorting, refrigerated storage, and transportation that make up the biggest cost components. These components have increased and remained elevated which has increased the price pressure on the growers as their relative share of the cost has declined.

Even with all the input costs increasing and a couple of years of below-average yields, the retail price of Honeycrisp apples has not increased dramatically when compared to increases over the last decade. The 2023 retail price for conventional Honeycrisp apples was 4.5% higher than the 2019 price, though the organic price moved up by a more noticeable 16.6% in the same time period. Looking back at the Honeycrisp price history, we see that it has had a big cycle down. The 2019 price represented the lower part of the cycle as supply caught up to the demand.

The apple market is a continual shuffling of varieties. Orchard owners make multidecade bets when they plant a certain variety. They juggle issues like yield, varietal competition, and royalty pricing, plus a host of other variables. It’s not surprising to see orchard owners chase winners like Honeycrisp with more acreage, eventually capping the pricing over time.

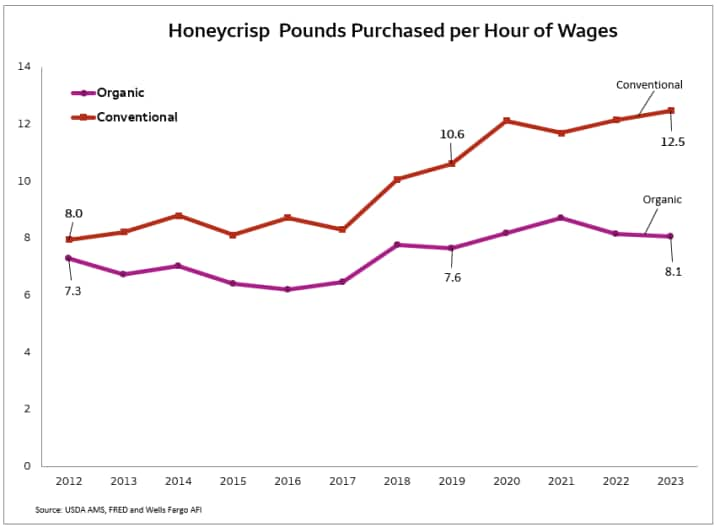

Finally, we need to consider purchasing power at the consumer level. I use average wage rates as a proxy for consumer purchasing power for a couple of reasons. First it is a long-running data series that allows us to compare things for decades. And second, everyone understands hourly wages. Purchasing power compares dollars per unit to dollars earned per hour. The graph below depicting purchasing power looks very different than the retail price graph above. First, the conventional line flips places with the organic line with more pounds of apples being purchased for an hour's work. Second, both of the lines trend up over time indicating that you can get more Honeycrisp apples today than in the past for an hour's wage. Using the same 2019 to 2023 time comparison, conventional Honeycrisp apples were 18% more affordable and organic Honeycrisp were 6.6% more affordable.

This might seem counterintuitive to the consumer who only sees the surprisingly high dollar amount at the end of the check-out line. However, it just goes to show that "human intuition" needs to read the book Thinking Fast and Thinking Slow by Daniel Kahneman before making any bold statements. The takeaway for the apple growers and packers in Washington state is that consumer demand remains strong because of the great value the consumer is recognizing with their product. It does not mean there is easy money to be made, but the growers and packers who continue to adapt will see economic returns that keep the apple industry sector growing.

Michael Swanson, Ph.D. is the Chief Agricultural Economist within Wells Fargo's Agri-Food Institute. He is responsible for analyzing the impact of energy on agriculture and strategic analysis for key agricultural commodities and livestock sectors. His focus includes the systems analysis of consumer food demand and its linkage to agribusiness. Additionally, he helps develop credit and risk strategies for Wells Fargo’s customers, and performs macroeconomic and international analysis on agricultural production and agribusiness.

Michael Swanson, Ph.D. is the Chief Agricultural Economist within Wells Fargo's Agri-Food Institute. He is responsible for analyzing the impact of energy on agriculture and strategic analysis for key agricultural commodities and livestock sectors. His focus includes the systems analysis of consumer food demand and its linkage to agribusiness. Additionally, he helps develop credit and risk strategies for Wells Fargo’s customers, and performs macroeconomic and international analysis on agricultural production and agribusiness.

Michael joined Wells Fargo in 2000 as a senior economist. Prior, he worked for Land O’ Lakes and supervised a portion of the supply chain for dairy products, including scheduling the production, warehousing, and distribution of more than 400 million pounds of cheese annually, and also supervised sales forecasting. Before Land O’Lakes, Michael worked for Cargill’s Colombian subsidiary, Cargill Cafetera de Manizales S.A., with responsibility for grain imports and value-added sales to feed producers and flour millers. Michael started his career as a transportation analyst with Burlington Northern Railway.

Michael received undergraduate degrees in economics and business administration from the University of St. Thomas, and both his master’s and doctorate degrees in agricultural and applied economics from the University of Minnesota.

Sign On

Sign On