Sustainability

Sustainability

Wells Fargo seeks to meet the financial needs of our customers, clients, and communities. From households to large businesses, we work with our customers to provide the financial tools to help serve an evolving set of needs. Whether customers are seeking to pursue their own sustainability goals or make their businesses more resilient, Wells Fargo can be a source of insights and financing.

Wells Fargo is also making progress to strengthen our own operational sustainability. Across certain offices and branches, we are installing energy and water efficiency measures and innovative building technologies. We are also procuring renewable electricity to power a number of those facilities. These investments can help lower long-term operating costs and improve the experience of employees and customers, while also supporting the Company’s operational sustainability goals.

The information below provides insights into the Company’s ongoing work related to sustainability, including progress towards our sustainable finance and operational sustainability goals. It also highlights our support for communities and employees, and provides information on certain corporate governance activities.

We are proud of the positive contributions we are making in service of our clients and communities. For further information on related topics, review our Sustainability Disclosure Index (PDF).

Forward-Looking Statements. Information contained on the Sustainability site speaks only as of the date of its publication on December 22, 2025, unless otherwise noted. We undertake no obligation to update the information, whether as a result of new information, future developments or otherwise, except as may be required by law. Forward-looking information contained on this site is subject to risks and uncertainties. Refer to the “Disclaimer and Forward-Looking Statements” section below and to our reports filed with the Securities and Exchange Commission for additional important information, including factors that could cause actual results to differ materially from our expectations.

Sustainability approach

Wells Fargo leverages its scale and expertise to support sustainability and resilience for our operations, clients, and communities. Our approach is client-centric. As clients’ sustainability-related needs evolve, Wells Fargo is preparing to meet those needs and pursue the developing commercial opportunity.

Our efforts to embed sustainability into our own operations enable us to test and deploy solutions that can lower operating costs, increase resiliency, and connect our teams with emerging innovations. This work is supported by our commitment to a strong risk and control culture, along with governance practices that help us adapt to and manage in a rapidly changing world.

We developed our sustainability approach by considering industry best practices, voluntary standards and frameworks, and a range of stakeholder viewpoints, and we assess where our internal business strategy aligns with sustainability-related opportunities. We engage with stakeholders including non-governmental organizations and industry associations.

$500B

in sustainable finance by 2030

2050 goal

of net zero greenhouse gas emissions in scopes 1 and 2

70% reduction

in greenhouse gas emissions (scopes 1 and 2) from 2019 levels by 2030

50% reduction

in energy usage from 2019 levels by 2030

50% reduction

in total waste stream from 2019 levels by 2030

45% reduction

in water usage from 2019 levels by 2030

100%

of annual purchased electricity consumption needs with new renewable sources by 2030

Financing sustainable activities

We aim to help our clients pursue their own climate and sustainability-related objectives. Our approach is client-driven, as we aim to support their unique needs — from resiliency and financial health to bespoke and structured sustainability-labeled transactions.

The Sustainability team brings expertise, relationships and resources that support our lines of business as they work with clients to help them achieve their own sustainability objectives. The team seeks to improve enterprise integration and coordination of sustainability-related work. Key activities include providing subject matter expertise to bankers and clients on relevant market trends and policies, engaging with external stakeholders, and driving internal awareness and education.

Some clients and customers see opportunity and value in pursuing sustainability-related investments and activities, and an increasing need to improve resiliency. We aim to pursue this market opportunity in areas such as affordable housing, clean energy, transportation, and resource efficiency.

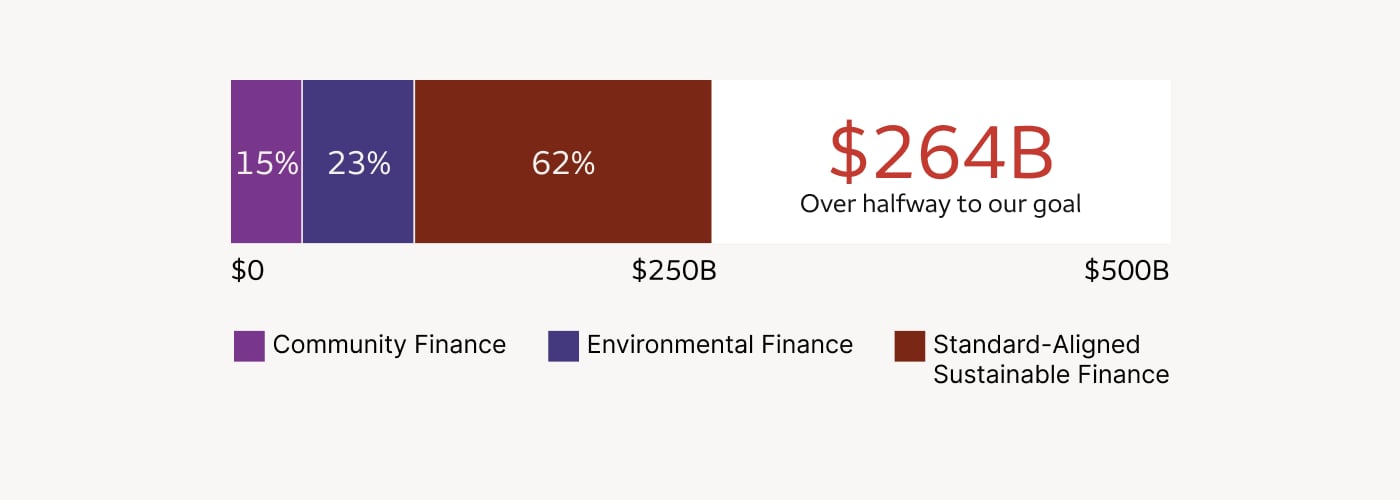

At Wells Fargo, we support our clients and customers in pursuing these opportunities. In 2021, Wells Fargo set a goal to finance or facilitate $500 billion in sustainable finance by 2030 to support our clients and customers as they pursue opportunities in both existing and emerging areas of sustainability. For more information on sustainable finance activities that count toward our goal, see Sustainable Finance at Wells Fargo December 2025 (PDF).

From 2021 to 2024, Wells Fargo originated, committed, advised, or facilitated approximately $264 billion in sustainable finance activities, representing approximately 53% of our $500 billion sustainable finance goal. Wells Fargo’s Institute for Sustainable Finance highlights examples of our sustainable finance initiatives.

Standard-aligned sustainable finance

Environmental finance

Community finance

Total $264 billion (100%)

Operational sustainability

Wells Fargo’s Corporate Properties Group supports our operational sustainability goals by facilitating efforts to reduce energy and water usage, reduce waste, source renewable energy, and reduce our Scope 1 and Scope 2 emissions. The team also partners with lines of business to provide insights and information to clients developing their own operational sustainability strategies, including renewable energy strategies and building performance standards.

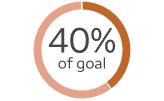

70% Reduction

in Scope 1 & 2 GHG Emissions from 2019 levels (40% of goal)

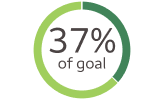

50% Reduction

in energy usage from 2019 levels (37% of goal)

50% Reduction

in waste stream from 2019 levels (98% of goal)

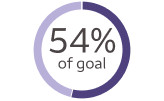

45% Reduction

in water usage from 2019 levels (54% of goal)

100% of our annual purchased electricity consumption needs with new renewable sources

For more information, please see our 2024 Operational Sustainability Performance Data (PDF).

Reinforcing our long-term strategy to support new sources of renewable energy, in 2024 Wells Fargo signed a 15-year commitment, our largest long-term renewable energy agreement to date. The newly constructed Texas solar facility will provide renewable energy to the Texas grid where we have infrastructure.

Much of our operational sustainability work is multi-year and ongoing. Highlights from 2024 include:

- Continuing to install high-efficiency lighting and lighting controls across Wells Fargo’s building footprint;

- Improving mechanical system efficiency through deployment of building management systems (BMS) and new and more efficient motors;

- Continuing water reduction practices including our ongoing smart irrigation program which leverages smart controllers to reduce irrigation water consumption;

- Implementing composting at several Wells Fargo U.S. campuses as part of our broader ongoing waste management program; and

- Adding onsite solar at six U.S. office campuses, one campus in India, and sixteen U.S. retail branch locations.

Wells Fargo continues to work towards enhancing operational sustainability across its global building footprint. In India, Wells Fargo leverages the U.S. Green Building Council’s suite of Leadership in Energy and Environmental Design (LEED) green building rating tools, specifically LEED Interior Design + Construction and LEED Zero to help advance the efficiency and comfort of our buildings. In 2024, in cooperation with the buildings’ landlord, five Wells Fargo occupied projects in India – four in Hyderabad and one in Bangalore – achieved LEED Zero – Water certification. LEED Zero – Water emphasizes the efficient and sustainable use of water.

As of the end of 2024, two Wells Fargo buildings in India are the world’s two largest LEED v4.1 Interior Design + Construction: Commercial Interiors Platinum certified buildings. Wells Fargo has locations in India that are also equipped with onsite organic waste converters which take wet waste generated from operations and convert it to compost to be used in landscaping.

The Philippines is also home to LEED Platinum certified Wells Fargo buildings and amenities such as solar EV charging stations for e-scooters and e-bikes which represent our multi-year focus on building efficiency and occupant comfort.

February 2025 statement on Wells Fargo’s climate goals & targets

Wells Fargo has long been a leading bank in the energy sector, financing conventional and low-carbon energy solutions. As of December 31, 2024, we had approximately $55 billion of outstanding commitments to oil, gas, pipeline companies and utilities, and we have provided over $20 billion of renewable tax equity since 2006. We have also deployed $178 billion of sustainable finance in three years, which includes $16 billion in renewable energy and over $15 billion in clean transportation finance.

Wells Fargo can play a role in supporting our clients’ climate-related efforts. However, when we set our financed emissions goal and targets, we said that achieving them was dependent on many factors outside our control. This included public policy, consumer behavior, and technology changes that would enable our clients to move quickly to lower-emitting operating models. Many of the conditions necessary to facilitate our clients’ transitions have not occurred.

We are adjusting our approach to focus on doing what banks do best – providing financing and expertise to help clients pursue their own objectives. As of February 28, 2025, we discontinued our sector-specific 2030 interim financed emissions targets and our goal to achieve net zero by 2050 for financed emissions.

We will maintain our 2030 sustainable finance goal; our 2030 operational sustainability goals; and our 2050 goal for Wells Fargo’s own operational emissions. Most importantly, we will continue to serve clients’ energy needs, meeting them where they are in their chosen energy and transition strategies. And we will work to meet the rising energy demands of the clients, customers, and communities we serve.

Sustainability governance

The management and oversight of sustainability-related risks are integrated into the risk programs supporting our businesses across the enterprise.

We leverage line of business risk and control committees for decision-making and escalation of risks and controls associated with sustainability-related activities. These committees include leaders from various lines of business and enterprise functions.

The Enterprise Risk & Control Committee reports to the Risk Committee of the Board of Directors and governs the management of all risk types. The committee is co-chaired by the Chief Executive Officer and Chief Risk Officer, with members including the heads of principal lines of business and certain enterprise functions. It is the most senior management committee responsible for reviewing and approving significant sustainability decisions.

At the Board-level, the Governance and Nominating Committee oversees the Company’s significant strategies, policies, and programs on social and public responsibility matters. The Risk Committee of the Board of Directors oversees the state of the Company's risk programs, including risks related to sustainability.

Indigenous Peoples Statement

For more than 65 years, Wells Fargo has provided capital and financial services to tribes and tribal-owned enterprises. Wells Fargo has banking relationships with 1 out of every 3 federally recognized tribes in the United States. We have committed approximately $4.6 billion in credit and hold approximately $3.7 billion in deposits for tribal governments and tribally owned enterprises nationally, banking more than 200 federally recognized Native American and Alaska Native tribes across the U.S. We are dedicated to serving Indigenous communities with products, services, and financial health programs tailored to help tribal clients, tribal governments, tribal enterprises, and tribal members succeed financially.

While the government of the United States provides formal recognition to American Indian and Alaska Native tribes, for purposes of this statement we use the term Indigenous Peoples to be inclusive of these communities and other tribal communities that may or may not be afforded the same recognition in their countries outside the United States.

As expressed in Wells Fargo’s Human Rights Statement, we are committed to respecting human rights.

We recognize that the identities and cultures of Indigenous Peoples are inextricably linked to the lands on which they live and the natural resources, including air and water, upon which they depend.

We respect Indigenous Peoples’ rights to determine their own way of life on their own lands, according to their time-honored cultures, traditions and beliefs. We recognize the rights of these communities to meaningful and appropriate consultation regarding issues affecting their sacred lands and natural resources – traditionally owned or otherwise occupied and used – today and for future generations.

While we recognize that governments have a central role to play in the approval of policies or projects that impact Indigenous Peoples, we seek to understand how our customers manage the impacts and risks of their activities. Through due diligence, Wells Fargo may engage with clients to understand their approach to managing potential impacts and risks to Indigenous communities. We intend to pursue high-quality business opportunities informed by appropriate assessment, applying risk management principles throughout our decision-making process.

Philanthropy and community impact

Wells Fargo is focused on contributing to a strong economy—one that is built on thriving communities. We look for ways to bring the breadth of our company’s resources and expertise to help address community needs and spark transformation.

We focus on three priorities for our community impact—improving housing access and affordability, accelerating small business growth, and empowering financial mobility. These three elements are central components to our efforts related to advancing economic empowerment and opportunity and equipping individuals with the knowledge and resources they need to achieve long-term financial stability. In addition, Wells Fargo supports the development of strong communities through disaster relief funding and engages employee volunteers across a range of local initiatives.

Since 2019, Wells Fargo & Company and the Wells Fargo Foundation have given more than $2 billion in support of housing, small business, financial health and more, to strengthen communities by investing in pathways to economic advancement and generational wealth.

Employee support

At Wells Fargo, we strive to be a great place to work where our employees can grow meaningful careers while supporting our efforts to serve a broad set of customers and clients. Listening to and learning from our employees helps us enhance the employee experience and drive improvements to our culture, programs and processes. We offer work-life benefits from career development and skill-building opportunities to competitive compensation and well-being support. We believe that by investing in our people, we’re investing in our future.

Questions?

Email sustainability@wellsfargo.com

Visit reporting and resources

Disclaimer and Forward-Looking Statements

The information on the Sustainability site is provided for information purposes only and reflects Wells Fargo & Company’s (“our” or the “Company’s”) approach to the topics on this site as of December 22, 2025, unless otherwise noted. Our approach is subject to change in the Company’s sole discretion without notice. The Company undertakes no obligation to update this site, or any information contained on this site, as a result of new information, future developments, or otherwise, except as may be required by law. Any goals, objectives, commitments, initiatives, or other information discussed on this site are not guarantees of future results, occurrences, performance, or conditions.

This site contains forward-looking statements about our business and other future conditions. In particular, forward-looking statements include, but are not limited to, statements about the Company’s sustainability, human rights, human capital and governance-related plans, objectives, and strategies, and expectations for our operations and business, as well as our goals, commitments, and initiatives related to sustainable finance, management of climate-related risks and opportunities, greenhouse gas emissions, and operational sustainability. Because forward-looking statements are based on our current expectations and assumptions regarding the future, they are subject to inherent risks and uncertainties. Do not unduly rely on forward-looking statements as actual results could differ materially from expectations.

While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: measurement uncertainties or other limitations with respect to data, methodologies, and models; the evolving standards and methodologies for measuring, reporting and verifying metrics; the development and adoption of new technologies and business models; the need for collaboration and action on the part of various stakeholders to help achieve goals, objectives, commitments and initiatives; the potential impact of legal and regulatory obligations and changes in laws, regulations, or public policy; changes in stakeholder perceptions and expectations; and changes in management’s strategies including our aspirational goals, objectives, commitments, and initiatives. For additional information about factors that could cause actual results to differ materially from our expectations, refer to our reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024, as filed with the Securities and Exchange Commission and available on its website at www.sec.gov.

Any references to “sustainable finance,” “sustainability-labeled transactions” “renewable energy,” “clean energy,” “clean technology,” “affordable housing,” “sustainability” or similar terms on this site are intended as references to the internally defined criteria of the Company, as applicable, and, except as specifically stated, not to any jurisdiction-specific regulatory definition that may exist. Any references to terms such as “significant,” “important,” “critical,” “material,” or similar terms should not be read as necessarily rising to the level of materiality of disclosures required under U.S. federal securities laws or other laws and regulations. In addition, terms used on this site may not be comparable to similar terms used by third parties. The Company’s goals, objectives, commitments, and initiatives are aspirational and purely voluntary, are not binding on the Company's business, investment decisions, and/or management, may be amended or cancelled at any time, and do not constitute a guarantee or promise of achievement of any such goals, objectives, commitments, or initiatives or of any actual or potential positive impacts or outcomes. The Company’s goals and initiatives related to greenhouse gas emissions should not be construed as a commitment by the Company to achieve a particular emissions-related outcome or a claim to realize a specific climate effect.

Information contained on this site is sourced from a variety of internal and third-party sources and may be based on emerging or evolving practices, assumptions, or estimates. The suitability of the design and effectiveness of any third-party systems and associated controls over the accuracy and completeness of such third party’s data, methodologies, or models has not been independently assessed by us.

The Company makes no representations or warranties as to the quality, completeness, accuracy, or fitness for a particular purpose of any information on this site and shall not be liable for any use by any party of, for any decision made, or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, such information. This site should not be used as a basis for trading in the securities of the Company or for any other investment decision. Unless otherwise indicated, the information on this site has not been verified or otherwise assured by an independent third party.

The information presented on this site does not provide the official plan provisions of the employee benefit plans sponsored by the Company, to the extent applicable. If there is any discrepancy between the information presented on this site and the official plan documents, the official plan documents will govern. The Company reserves the right to amend, modify, or terminate any of its benefit plans, programs, policies, or practices at any time, for any reason, with or without notice.

Any external links to third-party websites are provided for your convenience, but the Company does not endorse and is not responsible for the content, links, privacy policy, or security policy of such websites. This site is not intended to make representations as to the sustainability-related initiatives of any third parties, whether named on this site or otherwise, which may involve information and events that are beyond Wells Fargo's control.

All third-party trademarks or brand names are the property of their respective owners. The use of any third-party trademarks or brand names is for informational purposes only and does not imply an endorsement by the Company or that such trademark owner has authorized Wells Fargo to promote its products or services. The Company disclaims any representations or warranties regarding the non-infringement of any information contained on this site.

How was your experience? Give us feedback.

DT1-01082027-18-8136163-1.1