Tailwinds Emerge for the Windy City Economy

Tailwinds Emerge for the Windy City Economy

Chicago Economic Update

Summary

Chicago has endured no shortage of headwinds in the aftermath of the pandemic. Like most other large metropolitan areas, the knock-on effects of COVID weighed on population growth, constrained the labor market recovery and jarred local real estate conditions.

Encouragingly, however, the negative impacts of the pandemic era are subsiding, and the path forward for the Chicago economy is coming into focus. Less-restrictive monetary policy should promote a stronger pace of employment growth, especially in the influential professional services and finance industries where hiring has been stunted by increased capital costs.

In addition, Chicago's high-caliber research universities and stock of affordable and centrally-located real estate presents a compelling opportunity to attract outside residents and businesses. Meanwhile, the region's dense manufacturing, freight and logistics ecosystem is poised to flourish in an era of new industrial policy and supply chain reshoring. Near-term challenges are certain to remain as national economic growth slows and weak demographic fundamentals persist; however, tailwinds appear to be emerging for the Windy City economy.

Chicago's Economy Returning to Form

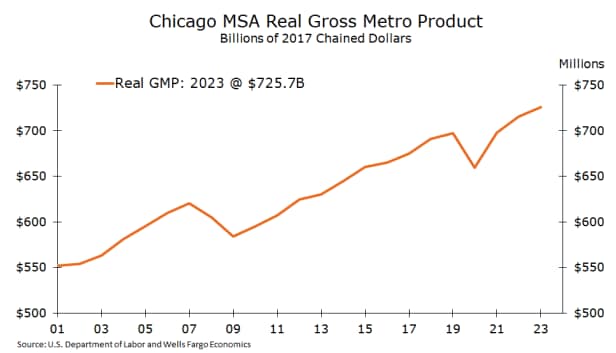

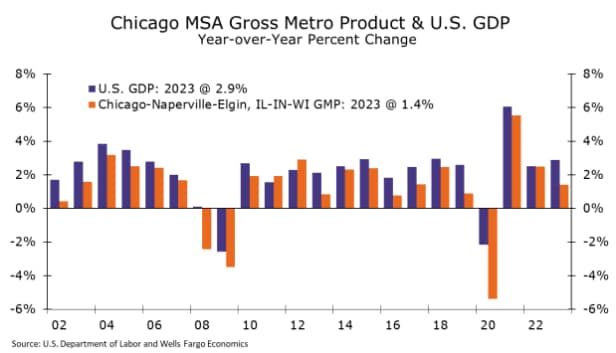

- The Chicago-Naperville-Elgin metro is the third largest economy in the nation, sitting behind New York and Los Angeles in terms of annual real gross metro product (GMP). Like many other large metros, Chicago was disproportionately impacted by the effects of the pandemic. Encouragingly, however, the local economy finally appears to returning to form. Real GMP in Chicago rose 1.4% during 2023 as a whole, bringing real output to 4.0% above the level recorded in 2019.

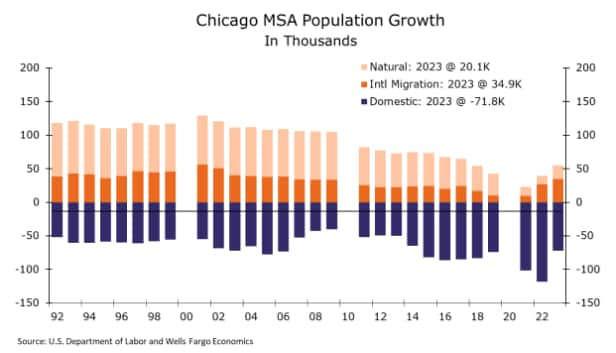

- Population trends appear to be normalizing as the lingering effects of COVID subside. After declining by 0.8% in both 2021 and 2022, population growth improved somewhat and fell by only 0.2% in 2023.

- During 2023, Chicago's population received a boost from natural causes and the largest increase in international migration since 2006. Net domestic migration remained in negative territory, but resident outflows thinned to the lowest total since 2014.

High Interest Rates Cool Chicago's Labor Market

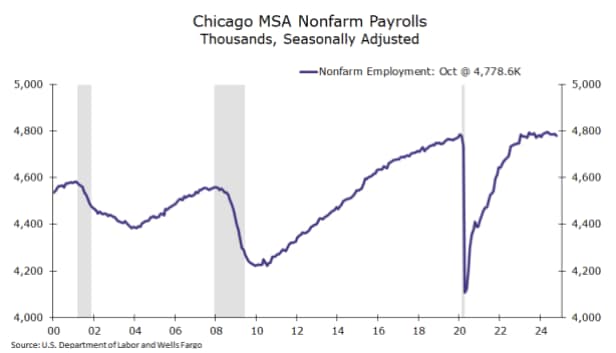

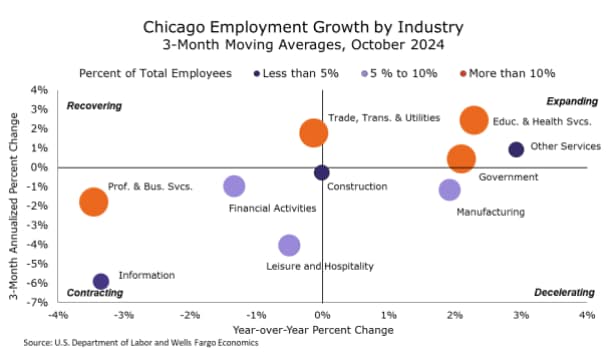

- Industry employment has returned to its pre-COVID peak. After growing strongly over the past several years, however, the pace of hiring has slowed, and payrolls were up a modest 0.1% on a year-over-year basis in October.

- The cooler pace of hiring appears mostly owed to a retrenchment in the metro's influential professional & business services and financial services sectors. The pullback in these two sectors, which together represent about 27% of total employment, has coincided with the Federal Reserve's efforts to curb inflation by raising the fed funds target rate. Hiring in these industries should be supported by easier monetary policy in the years ahead.

- Leisure & hospitality employment growth continues to lag, reflecting the slow return of tourism to the Second City. That noted, growing airport passenger volumes suggest that international, business and group travel is starting to pick back up again, which should bolster the metro’s leisure & hospitality sector moving forward.

- Employment growth has been more resilient elsewhere. Notably, hiring has held up better in the manufacturing, trade & transportation, healthcare, and education industries, as well as in the government sector.

Chicago's Labor Force is Expanding

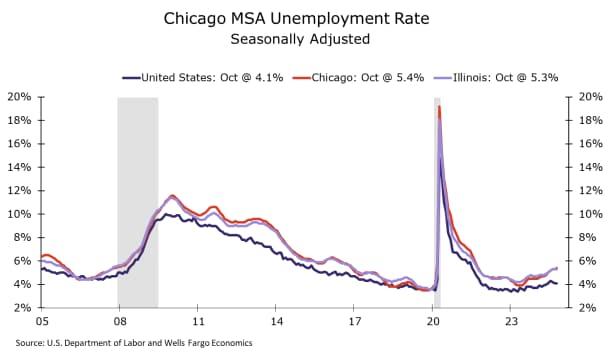

- Unemployment has been drifting higher recently alongside softening labor market conditions. The metro unemployment rate stood at 5.3% in September, up from a cycle low 3.9% hit in April 2023. Taking a step back, Chicago's unemployment rate is still well below the double-digit rates registered at the height of the past two recessions.

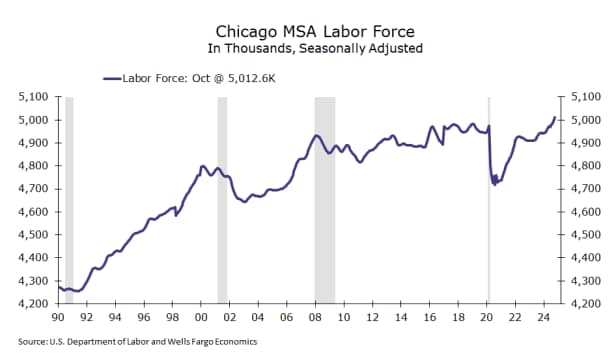

- The recent increase in the jobless rate is mostly the result of moderating employment growth, though faster labor force growth also may be exerting upward pressure. Chicago's labor force rose 1.4% on a year-to-year basis in October, the strongest annual pace in over two years. The metro labor force now amounts to over 5 million participants, the highest total on record.

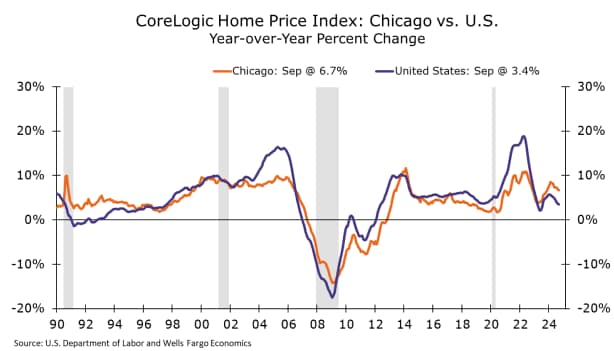

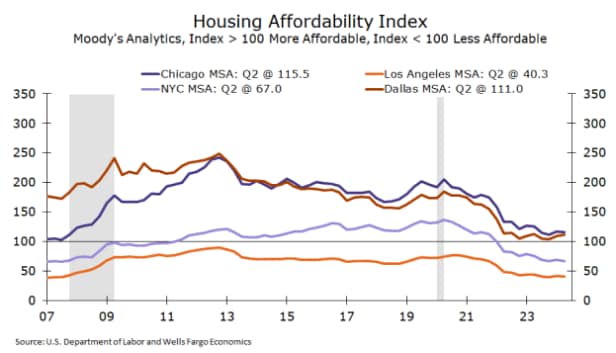

- Home prices in Chicago are rising faster than the national average. Despite higher mortgage rates and reduced sales volumes, low supply and improving economic growth have driven single-family home prices up nearly 7.0% over the year in September, ahead of the 3.9% national pace.

- Even with relatively strong home price gains, Chicago remains one of the most cost-effective large metro areas in the nation. According to Redfin, the median single-family home price amounted to $325K in October, below the national average of $434K. The region's affordability advantage extends to the apartment market where asking rents averaged $1,790 in Q3-2024, under most other major metros with comparable employment levels and urban amenities.

Industry Diversification in the City of Big Shoulders

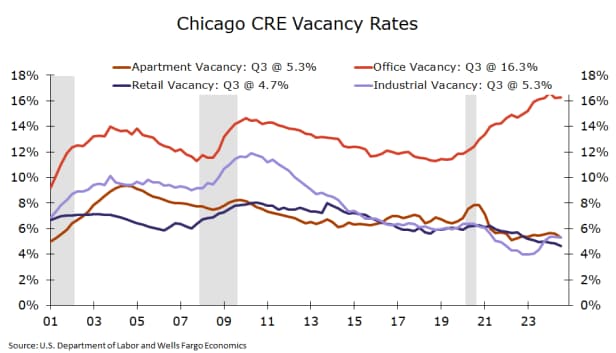

- Commercial real estate in Chicago has been jarred by the pandemic and increased prevalence of hybrid work. Although office vacancy rates have leveled off recently, occupancy remains well below pre-COVID trends. However, other major property types have outperformed against a backdrop of limited supply and sturdy demand. Retail vacancy rates have dropped to historical lows, while multifamily and industrial vacancy rates remain below their 2019 averages.

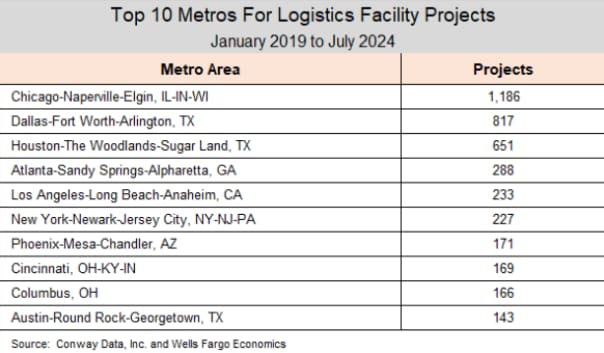

- Chicago still serves as North America's freight hub. Over 1,000 logistics projects have been completed since 2019, more than any other major metro. O’Hare airport is one of the nation’s largest and fastest-growing air-cargo hubs, and Chicago is a major rail interchange point, with roughly 25% of all freight trains in the U.S. passing through the metro. The region’s dense manufacturing and logistics network sets up the region for growth alongside increased investment directed toward fortifying supply chains and expanding domestic manufacturing capacity.

- The metro’s high-caliber research universities are driving an increasingly diverse industry landscape. The city is home to a growing cluster of tech startups, venture capital firms and unicorn companies that cut across a wide array of industries, including quantum computing, finance and life sciences.

Economists

Subscription Information

Let's connect to discuss how Wells Fargo can meet your current and long-term financial needs.

All estimates/forecasts are as of 12/5/2024 unless otherwise stated. 12/5/2024 6:00:02 EST

Required Disclosures

This report is produced by the Economics Group of Wells Fargo Bank, N.A. (“WFBNA”). This report is not a product of Wells Fargo Global Research and the information contained in this report is not financial research. This report should not be copied, distributed, published or reproduced, in whole or in part. WFBNA distributes this report directly and through affiliates including, but not limited to, Wells Fargo Securities, LLC, Wells Fargo & Company, Wells Fargo Clearing Services, LLC, Wells Fargo Securities International Limited, Wells Fargo Securities Europe S.A., and Wells Fargo Securities Canada, Ltd. Wells Fargo Securities, LLC is registered with the Commodity Futures Trading Commission as a futures commission merchant and is a member in good standing of the National Futures Association. WFBNA is registered with the Commodity Futures Trading Commission as a swap dealer and is a member in good standing of the National Futures Association. Wells Fargo Securities, LLC and WFBNA are generally engaged in the trading of futures and derivative products, any of which may be discussed within this report.

This publication has been prepared for informational purposes only and is not intended as a recommendation, offer or solicitation with respect to the purchase or sale of any security or other financial product, nor does it constitute professional advice. The information in this report has been obtained or derived from sources believed by WFBNA to be reliable, but has not been independently verified by WFBNA, may not be current, and WFBNA has no obligation to provide any updates or changes. All price references and market forecasts are as of the date of the report or such earlier date as may be indicated for a particular price or forecast. The views and opinions expressed in this report are those of its named author(s) or, where no author is indicated, the Economics Group; such views and opinions are not necessarily those of WFBNA and may differ from the views and opinions of other departments or divisions of WFBNA and its affiliates. WFBNA is not providing any financial, economic, legal, accounting, or tax advice or recommendations in this report, neither WFBNA nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this report, and any liability therefore (including in respect of direct, indirect or consequential loss or damage) is expressly disclaimed. WFBNA is a separate legal entity and distinct from affiliated banks, and is a wholly-owned subsidiary of Wells Fargo & Company. © 2024 Wells Fargo Bank, N.A

Important Information for Non-U.S. Recipients

For recipients in the United Kingdom, this report is distributed by Wells Fargo Securities International Limited ("WFSIL"). WFSIL is a U.K. incorporated investment firm authorized and regulated by the Financial Conduct Authority (“FCA”). For the purposes of Section 21 of the UK Financial Services and Markets Act 2000 (the “Act”), the content of this report has been approved by WFSIL, an authorized person under the Act. WFSIL does not deal with retail clients as defined in the Directive 2014/65/EU (“MiFID2”). The FCA rules made under the Act for the protection of retail clients will therefore not apply, nor will the Financial Services Compensation Scheme be available. For recipients in the EFTA, this report is distributed by WFSIL. For recipients in the EU, it is distributed by Wells Fargo Securities Europe S.A. (“WFSE”). WFSE is a French incorporated investment firm authorized and regulated by the Autorité de contrôle prudentiel et de résolution and the Autorité des marchés financiers. WFSE does not deal with retail clients as defined in MiFID2. This report is not intended for, and should not be relied upon by, retail clients.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

RO-4106599

LRC-0125