January 27, 2025

Dr. Michael Swanson, Chief Agricultural Economist; Courtney Schmidt, Sector Manager; and Robin Wenzel, Group Head, Wells Fargo Agri-Food Institute

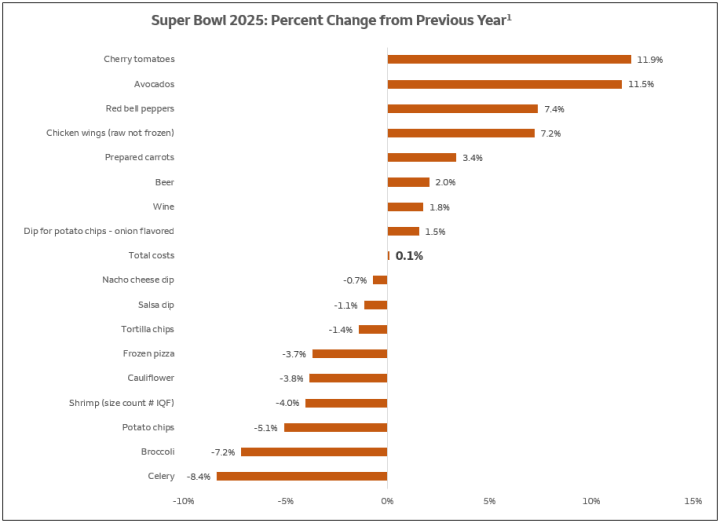

On the surface, the cost of celebrating the 2025 Super Bowl resembles the proverbial duck, representing a 0.1% increase in a year-over-year review. For a menu of food and drinks for 10 people including fan favorites, consumers will spend $139.* This is virtually the same price paid in 2024, which was only about ten cents more. Since this is good news, then why the duck reference? Because on the surface, a duck looks serene cruising along, but underneath the surface, the duck is paddling like mad.

Analyzing the data from NielsenIQ, which tracks food scanned at retailers across the U.S., we found a surprising spread in prices for popular game-day ingredients and prepared foods. This current landscape means party hosts will be challenged to seek a balance between items that are more expensive and those that have dropped in price if they want to control their party budget. So, why isn’t there an overarching, easily understood theme that explains everything? The answer is, this isn’t how the economy works. Consumers are faced with the new challenge of becoming “food fluent” given ongoing price fluctuation.

The following chart shows the spread of fan-favorite, game-day food pricing, and it resembles a playground seesaw stuck in the middle.

Given this topsy-turvy food environment, it’s important for shoppers to understand the dynamics of this year’s game-day favorites. Let’s start with an unexpected category: veggies.

Most Vegetable Player (MVP)

Why start with veggies in a Super Bowl food report? Veggies are top of mind as recent data explains how GLP-1 drugs are shifting consumer preferences and shopping patterns, and they highlight the seesaw effect of this year’s price terrain. Super Bowl party hosts will want to offer some healthy options and should monitor pricing across common dipping vegetables.

If broccoli sounds appetizing, fans are in luck with pricing down by 7.2% from 2024. Sounds like a call for creative broccoli recipes. However, if cherry tomatoes are a top pick, shoppers will spend 11.9% more compared to this time last year.

Avocado point spread

Avocados are having a seesaw moment as well. Fresh avocados are up 11.5% from last year, while prepared guacamole dip is up only 1.5% over the same period. Despite the increased cost of fresh avocados, consumers can still save money in the end by making guacamole from scratch. Convenience of prepared foods comes at a price, and labor costs make prepared guacamole less of a bargain even with the increased fresh avocado price. We should also remember that a game-day crowd can consume a lot of guacamole with their chips.

The pricing madness isn’t new to avocados and guac. One can look at different categories of avocado/guacamole dip and find double-digit, year-over-year price changes — both up and down. Avocado and guacamole pricing helps to emphasize that consumers must be attentive, savvy shoppers to get the most bang for their buck.

Chicken wing coin toss

One of the biggest ticket game-day menu items further illustrates the frustrating item-by-item price messiness. Unfortunately, chicken wing lovers are out of luck this year with prices up 7.2% versus last year. Chicken wings have continued their unstoppable growth and popularity on American restaurant menus, thanks to consumers supporting higher wing prices. This combined explanation helps to illustrate that beneath the surface for every food sector, there are many moving parts not seen by the consumer. With this food-focused celebration, consumers will have a chance to vote with their wallets on whether the moving prices for chicken wings are worth the extra spend.

Line of shrimpage

Still within the protein sector, and on the other side of the seesaw, retail prices for whole frozen shrimp have come down 4.0% in 2025 compared to last year. Why are shrimp prices down so much? Two big factors. First, the U.S. imports most of the shrimp we eat from a small set of countries that increased supply when shrimp prices increased around the COVID pandemic. Second, the U.S. retail shrimp demand softened as a result of higher shrimp prices. So, current lower shrimp prices are a rebalancing of these two big changes as the market works to balance the seesaw effect. And, while shrimp is two and half times more expensive per pound than chicken wings, some party hosts might wish to consider shrimp as the go-big, Hail Mary play for their Super Bowl spread.

Snacking station

Chips to accompany the dips illustrate a similar dynamic at the all-important snacking station. The avocados for the guacamole are up in a noticeable way. But, fortunately, the tortilla and potato chips are down, helping to offset the combined items. The total cost of chips and guacamole dip is just two pennies higher than last year. Of course, it’s easy to take the cost savings for granted and grumble about the fumble related to avocado prices. Just proves that even the little seesaws are balanced at the moment. Will there be additional forward momentum on cost savings for these categories for the rest of 2025? Stay tuned for Wells Fargo’s Agri-Food Institute July Fourth report.

Beverage instant replay

Some may call beverages an instant replay of last year’s costs, with both beer and wine seeing only minor 2% increases. Per usual, shoppers can save on soda by opting in for two-liters, versus 12-ounce cans.

Final score

So, what’s the winning game plan for the big game? You certainly could run a trick play with a massive tray of fresh broccoli. But, while saving a ton of money, your guests will likely throw a lot of penalty flags. The recommendation for the most budget-conscious party host is to plan an offensive strategy that involves paying the higher prices for one or two items to please your guests, with a defensive strategy that balances your costs with lower priced items. Happy guests are a winning outcome no matter which team winds up hoisting the Lombardi Trophy this year.

Michael Swanson, Ph.D. is the Chief Agricultural Economist within Wells Fargo's Agri-Food Institute. He is responsible for analyzing the impact of energy on agriculture and strategic analysis for key agricultural commodities and livestock sectors. His focus includes the systems analysis of consumer food demand and its linkage to agribusiness. Additionally, he helps develop credit and risk strategies for Wells Fargo’s customers, and performs macroeconomic and international analysis on agricultural production and agribusiness.

Michael Swanson, Ph.D. is the Chief Agricultural Economist within Wells Fargo's Agri-Food Institute. He is responsible for analyzing the impact of energy on agriculture and strategic analysis for key agricultural commodities and livestock sectors. His focus includes the systems analysis of consumer food demand and its linkage to agribusiness. Additionally, he helps develop credit and risk strategies for Wells Fargo’s customers, and performs macroeconomic and international analysis on agricultural production and agribusiness.

Michael joined Wells Fargo in 2000 as a senior economist. Prior, he worked for Land O’ Lakes and supervised a portion of the supply chain for dairy products, including scheduling the production, warehousing, and distribution of more than 400 million pounds of cheese annually, and also supervised sales forecasting. Before Land O’Lakes, Michael worked for Cargill’s Colombian subsidiary, Cargill Cafetera de Manizales S.A., with responsibility for grain imports and value-added sales to feed producers and flour millers. Michael started his career as a transportation analyst with Burlington Northern Railway.

Michael received undergraduate degrees in economics and business administration from the University of St. Thomas, and both his master’s and doctorate degrees in agricultural and applied economics from the University of Minnesota.

Robin Wenzel is a senior vice president and the head of Wells Fargo’s Agri-Food Institute, a team of national industry advisors providing economic insights, analytics, research, and reporting across the agribusiness, food, and beverage spectrum. With more than 30 years of commercial and corporate banking experience, Robin leads with a strategic vision and an ability to expand and execute on the team’s deliverables to better support Food, Beverage, and Ag customers and prospects.

Robin Wenzel is a senior vice president and the head of Wells Fargo’s Agri-Food Institute, a team of national industry advisors providing economic insights, analytics, research, and reporting across the agribusiness, food, and beverage spectrum. With more than 30 years of commercial and corporate banking experience, Robin leads with a strategic vision and an ability to expand and execute on the team’s deliverables to better support Food, Beverage, and Ag customers and prospects.

Robin received her degree in Business from the University of San Francisco with an interest in Finance and International studies.

Robin has long been recognized for her work as a leading voice in the wine industry in Napa, CA. She is also a recipient of the 2017 North Bay Business Journal Women in Business Award.

Courtney Buerger Schmidt is a Sector Manager within Wells Fargo’s Agri-Food Institute focused on the protein, cotton, and hay sectors. Courtney originally joined Wells Fargo in 2014 as a relationship manager within The Private Bank Wealth Management group where she spent two years prior to assuming her current role. Before Wells Fargo, Courtney spent six years as a commodity broker and research analyst with Frontier Risk Management developing hedge and risk management strategies for Agribusiness clients, and also served as assistant director of the research division that focused on livestock, grain, and oilseed.

Courtney Buerger Schmidt is a Sector Manager within Wells Fargo’s Agri-Food Institute focused on the protein, cotton, and hay sectors. Courtney originally joined Wells Fargo in 2014 as a relationship manager within The Private Bank Wealth Management group where she spent two years prior to assuming her current role. Before Wells Fargo, Courtney spent six years as a commodity broker and research analyst with Frontier Risk Management developing hedge and risk management strategies for Agribusiness clients, and also served as assistant director of the research division that focused on livestock, grain, and oilseed.

Courtney holds a Bachelor of Science degree in Agricultural Economics with an emphasis in finance and real estate from Texas A&M University. Courtney was recently selected for Texas Agriculture Lifetime Leadership (TALL) Cohort XVIII 2022-2024. She is also a member of the Texas A&M College of Agriculture Development Council .

*Data rounded to the nearest dollar.

Sign On

Sign On