Your company may quickly turn accounts receivable into cash, reduce financing costs, and enhance working capital through an early payment program, provided by Wells Fargo. Wells Fargo provides the option to receive cash early at a competitive rate that may leverage a buyer's financial strength.

Benefits of supplier finance programs

The early payment program may offer the following benefits:

- Increased cash flow and borrowing capacity

- Lower borrowing costs, that reflect your buyer’s favorable borrowing rates

- Improved working capital metrics from lower accounts receivable balances and accelerated cash flow

- Payment and remittance transparency via online portal and email notifications

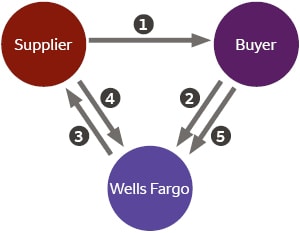

How the early payment program works

The program consists of five steps shown below:

- Supplier ships goods and sends an invoice to the Buyer using existing process

- Buyer approves the invoice and sends notification to Wells Fargo for payment

- Wells Fargo sends payment to Supplier via ACH or wire

- Wells Fargo takes ownership of invoice upon supplier receipt of payment

- Buyer funds Wells Fargo for the full amount of the payment due on the invoice due date

Sample savings calculation

In the example below, the supplier would save $87,389 annually and receive payments on day 10 instead of day 120.

| Without program benefits | With program benefits | |

|---|---|---|

| Annual sales to buyer | $10,000,000 | $10,000,000 |

| Proposed payment terms / payment receipt date | 120 | 10 |

| Current cost of capital | 9.50% | 9.50% |

| Discount margin | n/a | 1.75% |

| Benchmark rate Term SOFR | n/a | 4.89% |

| Program all-in rate | n/a | 6.64% |

| Carry cost through payment date | $316,667 (120 days @ 9.50%) | $26,389 (10 days @ 9.50%) |

| Discount cost | n/a | $202,889 (110 days @6.64%) |

| Total cost | $316,667 | $229,278 |

| Annual savings with program | n/a | $87,389 |

Enrollment and payment steps

1. Complete information form

- Wells Fargo will provide your company a copy of the form to start the enrollment process

- If you need a copy of the form, please contact us at WFCFSupplierFinance@wellsfargo.com

2. Sign agreement

- Wells Fargo will provide your company a Receivables Purchase Agreement to sign

- If your company has a secured bank lending relationship, Wells Fargo will provide a lien release document for your company and bank to sign

3. Fund

- Wells Fargo will advise supplier of the go-live date for the first invoice purchase

- Upon a buyer’s confirmation of approved invoices, Wells Fargo will have the option to purchase it by providing immediate funds based on your company’s set up preference

Key provisions of the receivables purchase agreement

- Your company assigns rights of its purchased accounts receivable to Wells Fargo

- Wells Fargo assumes ownership and title to receivables upon payment

- Only invoices approved by buyer are eligible for purchase

- Transactions are intended to be non-recourse

- Invoice purchase is not a loan

Sign On

Sign On